In a previous article about options basics, we talked about the differences between stocks vs. options, states Markus Heitkoetter of Rockwell Trading.

In this article, we will dive deeper into the five things you need to know about options.

The first thing you need to know is the strike price.

You will learn…

- what a strike price is

- the different intervals for strike prices

- how to pick the right strike price

- … and much more

Let’s get started.

1.) The basics: What is the strike price?

Strike Price Definition: The strike price of an option is the price at which the option buyer has the right to buy or sell an underlying security.

As an example, if you are buying a CALL option of Apple (AAPL) with a strike price of 126, then you have the right to BUY 100 shares of AAPL for $126. And if you are buying a PUT option of AAPL with a strike price of 125, then you have the right to SELL 100 shares of AAPL for $125.

Strike Price Intervals

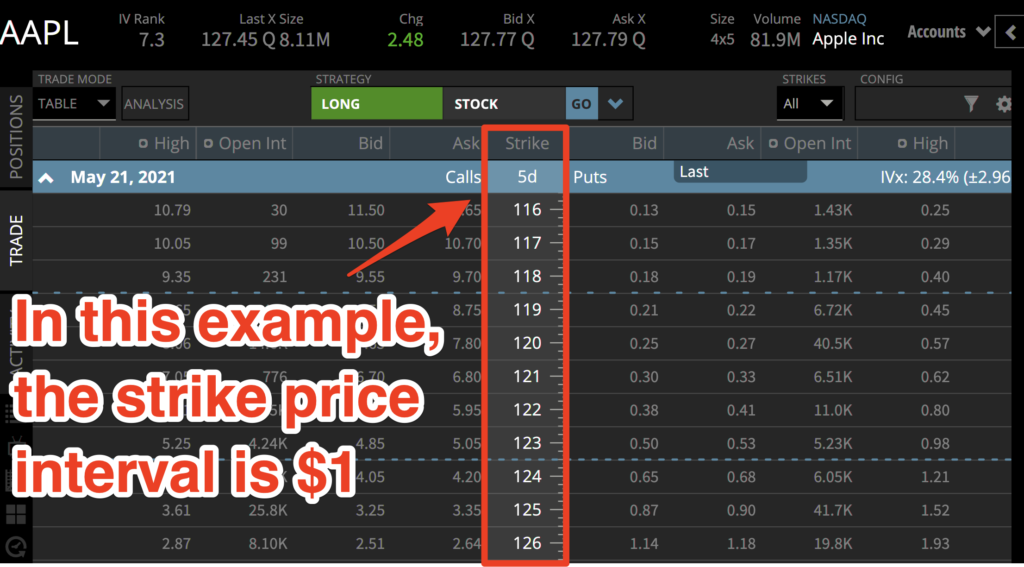

When you open an options chain, you will see all the different strike prices that are available. In this example, the strike price interval is $1.

But it’s not always $1. The strike price intervals are set by the options exchange and will change depending on market conditions and the price of the underlying stock.

There are four commonly used strike price intervals: $1, $2.50, $5, and $10.

There are currently no strict standards and the exchange reviews and decides on the strike price interval of each optionable stock from time to time in order to adjust policies to better cater to trading needs.

Here are some general guidelines provided by the Chicago Board Options Exchange (CBOE):

- 2.50 points strike price interval is used when the underlying stock is trading between $5 and $25

- 5 points strike price interval is used when the stock is trading between $25 and $200

- 10 points strike price interval is used when the stock price is over $200.

But these are just guidelines. The options exchanges decide on strike price intervals based on market demand and trader’s needs more than any strict mathematical formula. In the example above, you see that AAPL is trading at about $127. So according to the guidelines, the strike price interval should be $5. But since AAPL is a very volatile stock that currently moves $2.50 per day on average, which is around 2% per day, the $5 strike price intervals wouldn’t make sense. That’s why the exchange decides to only offer $10 intervals to best serve the trader.

Strike Price, Option Premium & “Moneyness”

When buying or selling an option, you must choose a strike price.

And often you will hear terms like:

- In-The-Money (ITM)

- At-The-Money (ATM)

- or Out-Of-The-Money (OTM).

I call this the “Moneyness” of an option. Let me show you a specific example to explain what this means:

In-The-Money Options Strike Prices (ITM)

ITM call options will have strike prices below the current stock price. And ITM put options will have strike prices above the current stock price.

In the example above, AAPL is trading at around $127 right now. Therefore, the strike prices of 125 and below are considered ITM for call options. And the strike prices of 128 and above are considered ITM for put options.

At-The-Money Options Strike Price (ATM)

An ATM option would be the closest strike price to the current market price of the stock. For our AAPL example (The current price is about $127), the strike prices of 126 and 127 are the closest strikes to the market. So, these strikes are considered ATM for both call and put options.

Out-Of-The-Money Options Strike Prices (OTM)

An OTM call option’s strike price would be above the current market price of the stock. With an OTM put option, the strike price would be below the current market price of the stock.

For our AAPL example (The current price is about $127), the strike prices of 128 and above are considered OTM for call options. And the strike prices of 125 and below are considered OTM for put options.

2.) How to Pick the Right Strike Price

Wow! So many strike prices! So how do you pick the right option strike price? Are some strike prices more desirable than others? Absolutely!

It really depends on what you are trying to accomplish:

Do you want to BUY an option and make money?

Do you want to SELL an option, collect premium, and let it expire worthless or,

Do you want to SELL an option, collect premium, and get assigned?

For now, let’s keep it easy. Let’s say you want to make money with a CALL option.

Call option strike price example

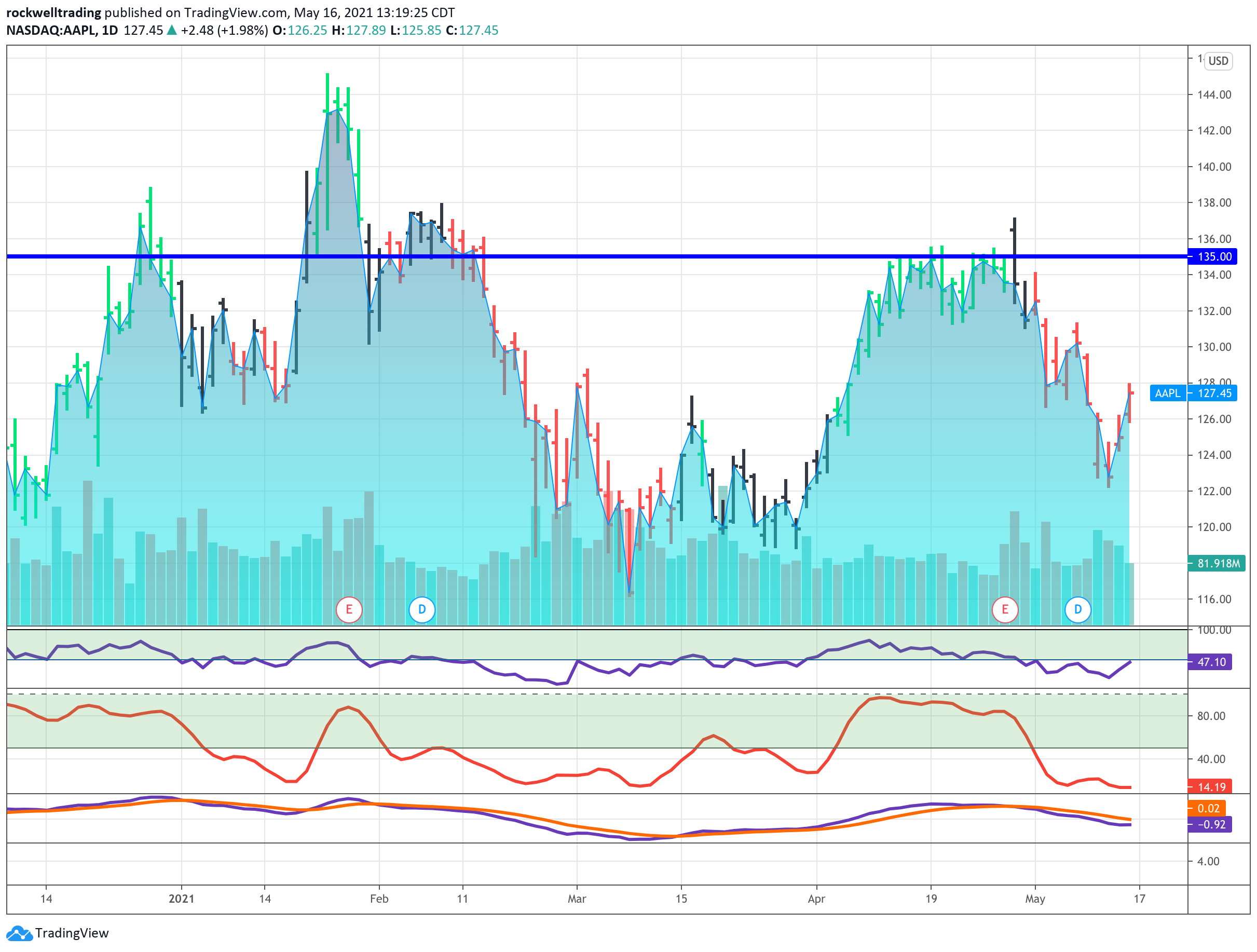

We will use AAPL again as an example. Right now, AAPL is trading at about $127. Let’s say you’re bullish AAPL and expect Apple to move up to 135 within the next month.

Let’s take a look at the option chain:

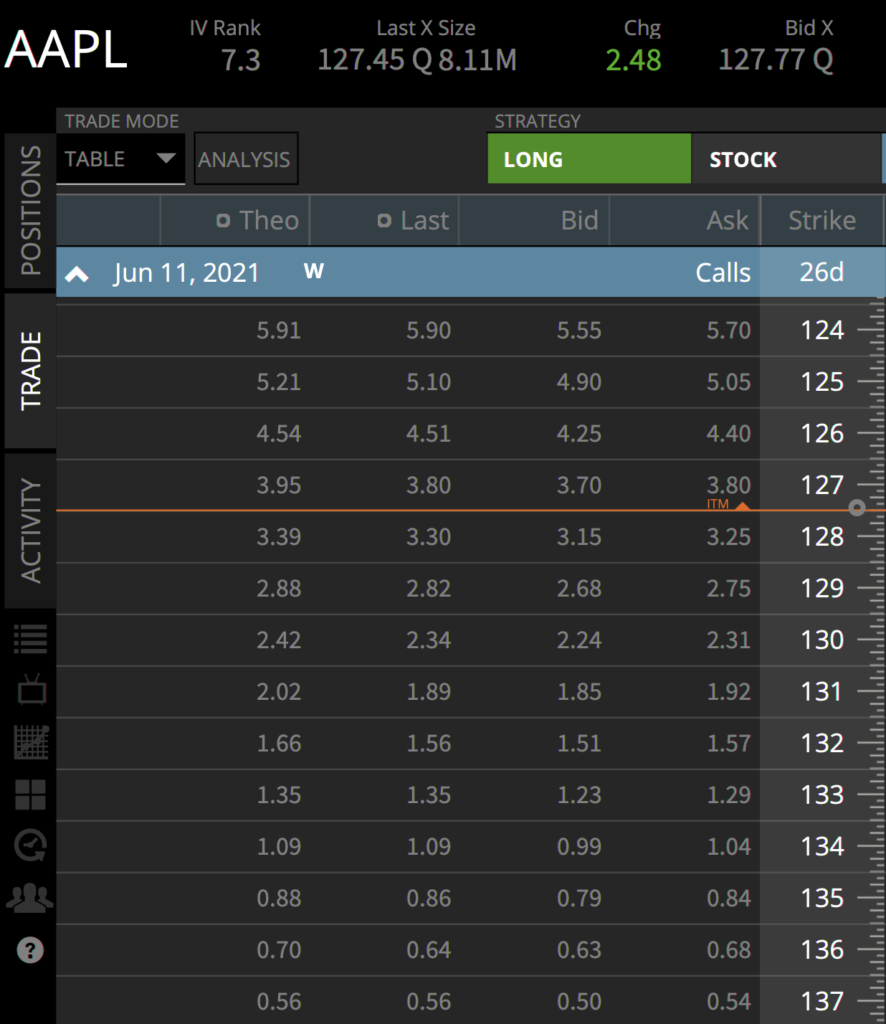

You now have several choices:

1.) You can buy a cheap OTM option with a strike price of 135.

The last price of the option was $0.86.

Since options come in “100 packs”, you would have to pay $86 for the option. This would allow you to buy 100 shares of AAPL at a price of $135.

2.) You can buy an ATM option with a strike price of 127.

This option is more expensive. The last traded price was $3.80, so you would have to invest $380 for this option.

And this option would allow you to buy 100 shares of AAPL at a price of $127.

3.) You can buy an ITM option with a strike price of 124.

This option is the most expensive. The last traded price was $5.90, so you would have to invest $590 for this option.

And this option would allow you to buy 100 shares of AAPL at a price of $124. Now let’s say that AAPL never goes back up to $135. Let’s say that on expiration day (June 11), AAPL is trading at $134:

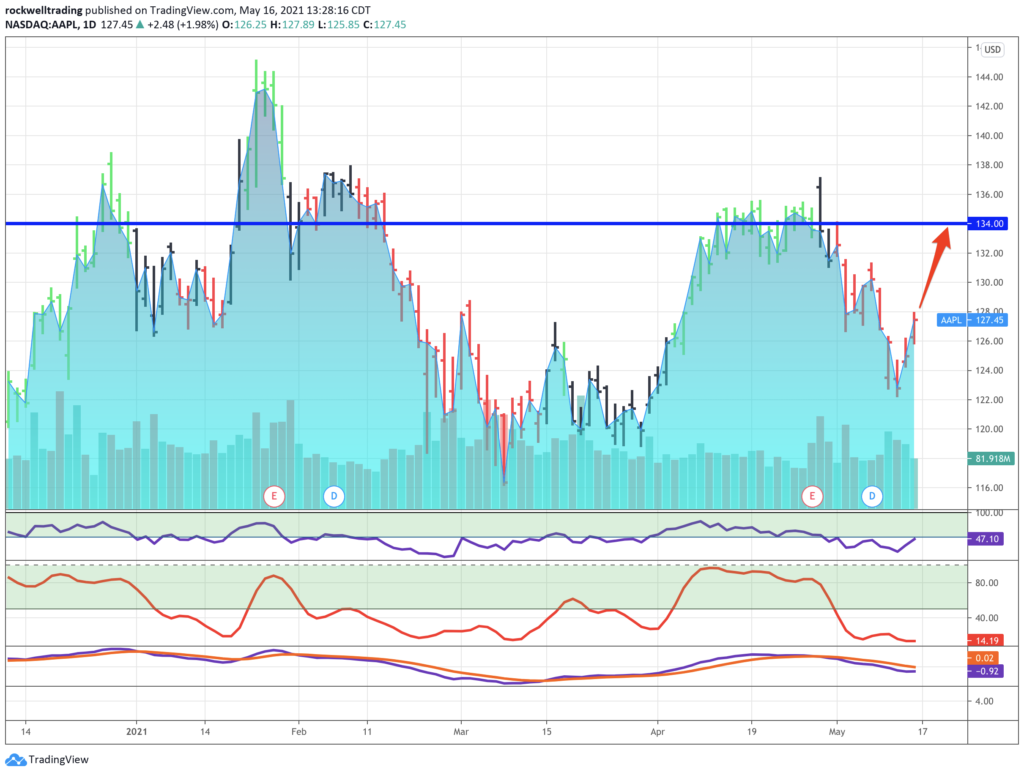

That’s still a pretty good move. So, let’s take a look at our choices:

1.) OTM Option with a strike price of 135

This option allows you to buy 100 shares of AAPL at $135.

Since AAPL is trading at 134, that wouldn’t make sense. Why would you pay MORE for 100 shares of AAPL than the underlying stock price? This option is worth nothing, and you lose the $86 option premium that you paid.

2.) ATM Option with a strike price of 127

This option allows you to buy 100 shares of AAPL at $127.

Since AAPL is trading at 134, you could buy 100 shares at $127 and immediately sell them for $134. In this case, you would make 134 – 127 = 7 per share.

1 option allows you to buy 100 shares, so your profit is $700. You paid $380 for this option and make $700. That’s a net profit of 700 – 380 = 320 or 84% based on your initial investment!

3.) ITM Option with a strike price of 124

This option allows you to buy 100 shares of AAPL at $124.

Since AAPL is trading at 134, you could buy 100 shares at $124 and immediately sell them for $134. In this case, you would make 134 – 124 = $10 per share. 1 option allows you to buy 100 shares, so your profit is $1,000. But you paid $590 for this option to make $1,000. So, the net profit of this trade is 1,000 – 590 = 410 or 69% based on your initial investment.

Picking the Wrong Strike Price

Let’s review:

OTM Option: $86 loss

ATM Option: $320 profit = 84%

ITM Option: $410 profit = 69%

As you can see from this example, it’s super important to pick the right strike price. The underlying security AAPL moved from $127 to $134. That’s a 5.5% move. Often traders who are new to options pick the cheapest options contract, i.e. the OTM option. But you would have lost the whole option premium. So should you pick the most expensive one?

As you can see in this example, picking the most expensive option (i.e. ITM option) would have yielded the higher DOLLAR amount. But in terms of return on investment (ROI), the ITM option was best.

Based on the trading strategy that you use; I can give you several guidelines on how to pick the right strike price. In a nutshell, when you are BUYING options, you want to buy an ATM or ITM options contract. And when you are SELLING options, you want to sell OTM options.

More about that later.

3.) Three Important Things You Need to Know

There are three more things you need to know when about strike prices when trading options:

What happens when a call option hits the strike price?

What would have happened if AAPL would have traded above the strike price of $135 before expiration? Nothing–unless you choose to exercise the option. But if this happens before the expiration date, then it would be better to sell the option since you would make more money.

How do I change my strike price once the trade has been placed already?

You can’t. You need to choose a strike price when you enter the trade, and you can’t change it while you are in a trade. You can only “roll” the option, and here’s how it works:

Let’s say you bought the OTM option with a strike price of $135. And you realize that it was too ambitious and that AAPL probably won’t hit 135 before the expiration date. So you could “roll” the option by selling your 135 call and simultaneously buying the 132 call.

What Is Spot Price and Strike Price

The SPOT PRICE is the current price of the underlying security, so using AAPL as an example, Apple’s current spot price, at the time of this writing, is $126.76, which is the price it’s currently trading. The STRIKE PRICE is the price at which you can buy or sell the shares of the underlying security on or before expiration.

Summary

As you can see, picking the right option strike price is extremely important. It will affect your returns and it could even make or break you in the market. In a nutshell, when you are a BUYER, you want to buy ATM or ITM options since even a small move in the underlying stock price can yield double-digit returns.

When you are a SELLER, it’s the opposite: You want to sell OTM options that have a low probability of getting assigned.Learn more about Markus Heitkoetter at Rockwell Trading.