On December 21, 2020, Donna shared with me a successful trade she executed with Financial Select Sector SPDR (XLF). What made this trade interesting was that the option was exercised after expiration when the strike closed out-of-the-money, explains Alan Ellman of The Blue Collar Investor.

This article will examine the reasons for this unusual circumstance.

Donna’s Trade

- 11/24/2020: Buy 300 x XLF at $28.59

- 11/24/2020: STO 3 x 12/18/2020 $29.00 calls at $0.50

- 12/18/2020 (expiration Friday): XLF trading at $28.52

- 12/18/2020: Since the strike was OTM, no rolling action was executed

- 12/18/2020: After-hours, XLF moved up to $29.63

- 12/19/2020: The 3 contracts were exercised and Donna’s shares were sold at $29.00

Initial Trade Structuring on 11/24/2020

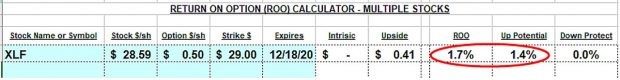

XLF: Calculations with the Ellman Calculator

The initial time-value return on the option (ROO) was 1.7% with an additional 1.4% of upside potential for a total 24-day maximum return of 3.1%. That max return was realized when the shares were sold after contract expiration.

Five-Day Chart Around Contract Expiration

XLF Chart Around Expiration of the December 2020 Contracts

- Red circle: Contracts expire at 4:00 pm ET on 12/18/2020

- Green arrow: Price moves up at market open on Monday but never reaches the $29.00 previous strike price

- Purple circle: Price reaches as high as $28.85 before declining

Two Explanations

1.After-hours news: Informal news about naming Janet Yellen as the new Treasury Secretary was initially met favorably by the financial community. Market-makers have until 5:30 pm ET to notify the OCC about exercising options.

2. XLF had an ex-dividend date on Monday 12/21/2020 making Friday 12/18/2020 a potential target for exercise. In general, the trading date prior to the ex-date is the most likely candidate for early exercise. Donna did not capture the $0.15 per-share dividend but did enjoy a hugely successful covered-call trade.

Discussion

Out-of-the-money call strikes are rarely exercised. When they are, after-hour news and ex-dividend dates are two of the more prominent explanations.

Learn more about Alan Ellman on the Blue Collar Investor Website.