The S&P 500 looks to be in a healthy and solid uptrend. However, digging deeper, we see warning signs that merit a hedge to protect against downside risk this summer, notes Elliott Gue, editor of Capitalist Times.

We’re not calling for a bear market in 2017 or even in the first half of 2018. The economic data still point to stronger economic growth in the second half of 2017. In addition, there aren’t any of the major warning signs we look for to forecast recession in the near term.

Moreover, historically it’s extremely painful to bail out of the stock market in the final stages of a bull market. In the final 12 months of a bull market, the S&P 500 returns an average of about 25 percent.

Moreover, the average has never returned less than 10 percent in the final year of a bull run, with the maximum return being 40 percent.

That said, the stock market sees an average of two to three 5 to 10 percent pullbacks each year. And in less than 10 percent of years since the 1930s has the market failed to see a correction of this magnitude.

It’s possible 2017 could be in that 10 percent of years where the market’s rally is uninterrupted. But we wouldn’t bet on that. Plus, we see technical signs of trouble ahead.

This year’s rally has been steady and smooth, with only two tiny corrections–March for 3.3 percent and May for 2.1 percent. In fact, the S&P 500 hasn’t even touched its rising 100-day moving average once this year.

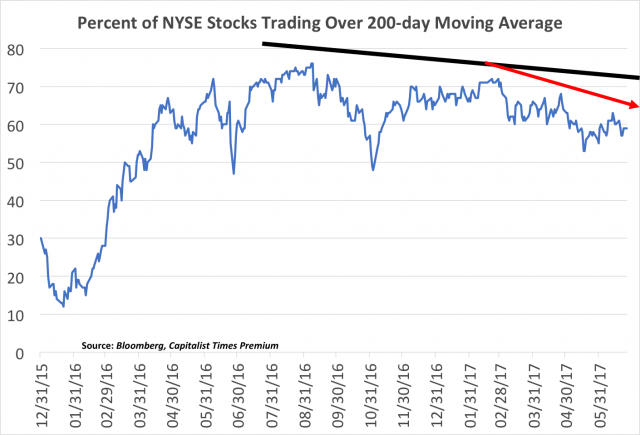

It’s a textbook uptrend. That said, look under the surface and it becomes clear the rally is supported by a dwindling number of stocks.

Meanwhile, some of the largest technology stocks in the US–the names that have contributed most to the rally so far this year–trade at stretched, or at least “optimistic,” valuations.

Specifically, technology stocks are a crowded trade and have been the beneficiary of huge amounts of capital from quantitative and passive funds this year.

There are plenty of catalysts that could prompt a shift out of technology and into other groups. These other groups could range from growth names to value stocks due to rising confidence in stronger US economic growth or progress of pro-growth legislation out of Washington, DC.

Alternatively, the shift could be prompted by simple technical factors such as quarter-end (and half-year) rebalancing undertaken by funds that are overweight tech due to strong first-half performance.

Once started, a strong sell-off in technology could feed on itself as institutional investors all sell the same handful of large-cap technology names at the same time.

Such a cascading sell-off would hit the tech-heavy NASDAQ Composite and NASDAQ 100 harder than the S&P 500. But the broader market would definitely be impacted by losses from its leading sector.

To guard against this risk, we’re adding the ProShares Short QQQ ETF (PSQ) as a hedge to our model portfolio. This fund is designed to rise 1 percent in value for every 1 percent daily decline in the NASDAQ 100.

Should the NASDAQ 100 break above its June 9 highs by a significant amount (5 percent or more this summer), we’ll look to close this hedge and take the loss.

Consider it a cheap insurance policy for the rest of your portfolio. However, should the NASDAQ 100 pull back, we see downside of at least 10 to 15 percent. In that case, this hedge will pay off.