Bank of America (BAC) recently reported second-quarter earnings per share of $0.46 a share; analysts’ estimates had ranged between 41 and 45 cents, notes Crista Huff, editor of Cabot Undervalued Stocks Advisor.

All business segments, except for bond trading, reported strong results. Results were boosted by recent Fed rate hikes, which contributed to BAC’s net interest income, a key source of profit.

As a result of the Federal Reserve’s recent approval of Bank of America’s 2017 capital plan, the company immediately announced a $12.9 billion increase in its share repurchase plan.

In addition, the quarterly dividend will increase from $0.75 to $0.12 quarterly, with a new yield of 1.98%. That increase won’t be reflected until the official dividend declaration takes place near August 1.

In mid-June, Morgan Stanley (MS) named Bank of America as the bank that’s best-positioned to capitalize on rising interest rates. Rising rates, in turn, boost net interest margins.

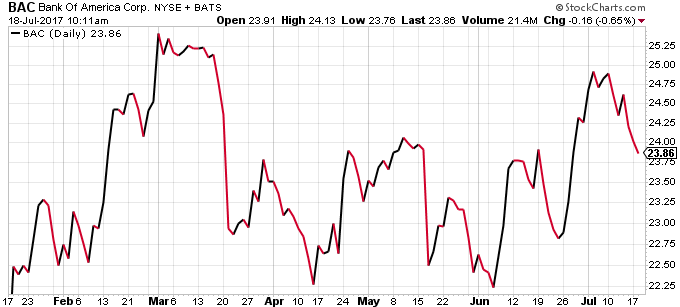

BAC is an undervalued large-cap bank with strong earnings growth. BAC has short-term upside price resistance at 25.5, which it could easily surpass this year, possibly even this month. I rate the stock a "Strong Buy".

Subscribe to Crista Huff's Cabot Undervalued Stocks Advisor here…