The age of robots is upon us. Indeed, I believe robotics is and will continue to be one of the best exponential growth industries you can invest in, notes Tony Daltorio, editor of Investing Daily's Growth Stock Advisor.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

According to the technology intelligence service, International Data Corporation (IDC), worldwide spending on robotics and related services in 2016 was $91.5 billion. IDC forecasts that figure to more than double to $188 billion in 2020.

The forecast makes sense with robots becoming useful in more and more sectors. The biggest spenders on robotics in 2016 were manufacturing, mining, consumer-related industries, and healthcare. IDC says the fastest uptake in the period to 2020 will come from the consumer, healthcare and retail industries.

The advance of the robots is being made possible by progress in technologies like big data, deep learning (artificial intelligence), graphics processing units and machine vision.

The reality is that many of us in the not too distant future will be working alongside a robot, whether it’s a real metallic one or a virtual one (AI bots). The term given to these type of robots is collaborative robots or cobots. I find them the most intriguing from an investment viewpoint because they are a disruptive technology.

The British market research firm, TechNavio, predicts cobots will become the fastest growing sub-sector of robotics. It sees the cobot market growing at a compound annual growth rate of 50.88% to 2019.

Cobots, from a mere $95 million sector in 2014, will become a sector worth more than a billion dollars by the end of the decade. In other words, it is moving from a niche market to a foundational technology of the future, growing at an exponential rate.

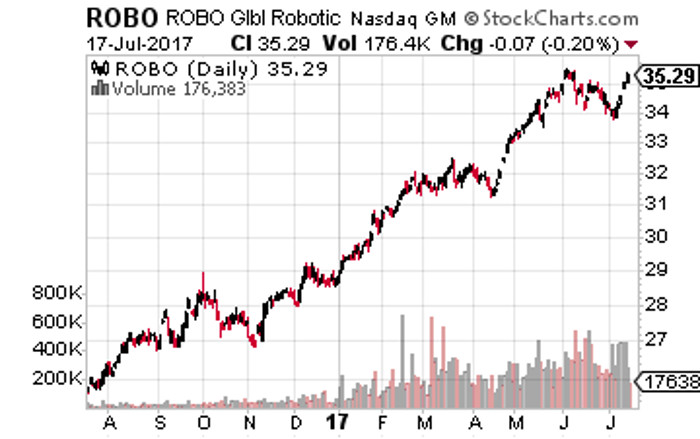

Unfortunately, there is no pure play cobots stocks. However, if you want a pure play on robotics, there are two ETFs that fit the bill — the Robo Global Robotics & Automation ETF (ROBO) and the Global X Robotics & Artificial Intelligence ETF (BOTZ).

Both are good choices with all of the leading companies in the broad robotics field globally. But there are differences in their respective portfolios.

One main difference between the two ETFs is that BOTZ is more concentrated. Its top position is Nvidia (NVDA), making up 7.7% of the portfolio. The top position at ROBO, Aerovironment (AVAV), makes up only 2.18% of the portfolio.

Another important difference is that BOTZ has more overseas exposure, with North America accounting for only roughly 25% of the portfolio. In contrast, ROBO has about 44% in North American companies.

In both cases, the low North American exposure is due to the fact that many of the top robotics-related, publicly-traded firms come from Japan.