There are clearly risks associated with high-yield investing in a dynamic rate environment. Why then go anywhere near income stocks at such a time? Investors need income, asks Stephen Biggar, senior editor of Argus Research, a leading independent research firm.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

Moreover, we have found that dividend growth stocks tend to hold their value better in periods of rising rates and deliver solid total returns in all markets.

Looking at historical return of stocks within the S&P 500 between 1972 and 2010, average annual return was 7.3%; but average annual return for companies that initiate or grow their dividends was 9.6% (source: Ned David Research).

To test this hypothesis, we examined the recent performance of the Argus coverage universe. We first started by excluding stocks that have not paid dividends over the past five years.

This screen left us with approximately 300 companies. We then cut the list into four different tranches, distinguished by dividend growth over that five-year period.

The results were interesting. We found that the top two tranches—which each averaged double-digit dividend growth—delivered solid double-digit returns even though they did not have the highest average yields.

Moreover, they had the highest cash-flow coverage ratios—a key financial strength measure. Tranche 4 had the highest yields, along with a history of dividend reductions and a low FCF coverage ratio.

Simply investing in the top two tranches from our study would be difficult. The resulting portfolio would include more than 150 stocks.

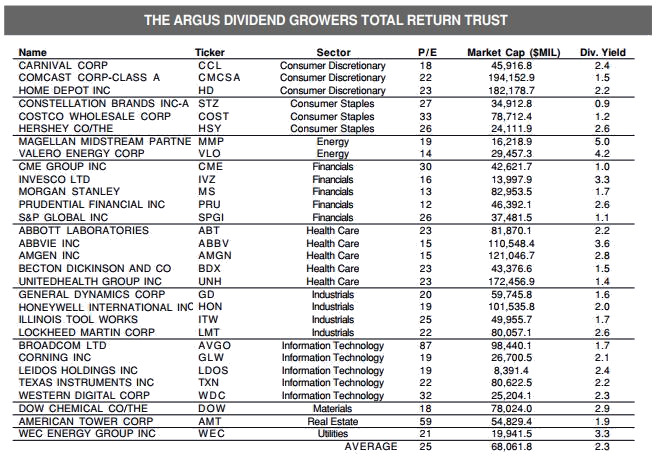

To build a more investor-friendly portfolio, we started with the top two tranches and then further narrowed the list to focus on companies that we think can outperform in the sector over the next 12 months, and made final adjustments for sector allocations.

The resulting portfolio is the basis for the Argus Dividend Growers Total Return Trust, Series 13, sponsored by SmartTrust Inc.