Like you, I get a lot of spam emails. Most of them are phishing attacks, offering me untold riches if I’ll just send my bank details to some Honorable Righteous General in Nigeria, observes tech sector expert Michael Murphy, editor of New World Investor.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

But phishing attacks are just one small part of the explosion in cybercrime. Everything from ransomware to hacking the SWIFT interbank money transfer system to stealing product plans to getting credit card numbers from the big chain stores adds up to a huge amount of money every year.

In 2016, businesses alone lost $1 trillion to cybercrime. That is forecast to hit $3 trillion by 2020. The main reason: Companies are woefully unprepared to defend themselves.

With that much money at stake, there will be an explosion of spending on cybersecurity over the next five to ten years. The global market should be over $200 billion by 2022.

There are many firms supplying pieces of the cybersecurity infrastructure, and they are all scrambling to expand the range of products they offer. One reason we owned Cisco Systems for a while was their program to acquire and roll-up numerous cybersecurity providers into a comprehensive offering.

Kroll, the risk management specialists, reported that 82% of the companies it polled were fraud victims in 2016. 60% of all illegal access and data theft came from inside the companies, from employees, contract workers, and freelancers.

Kroll said: “With fraud, cyber, and security incidents becoming the new normal for companies all over the world, it’s clear that organizations need to have systemic processes in place to prevent, detect, and respond to these risks if they are to avoid reputational and financial damage.”

So how to invest? There are numerous companies in this industry, with Palo Alto Networks (PANW) an obvious leader. But we want to participate in the whole industry’s growth, and there are two good ways to do that. Both are exchange-traded funds (ETFs).

The ETFMG Prime Cyber Security ETF (HACK) began on November 11, 2011, to track the ISE Cyber Security Index.

This index tracks the performance of the equity securities of companies across the globe that are either CyberSecurity Architecture Providers or CyberSecurity Application Providers. It has $3.4 billion in assets, a 34% turnover rate, and a low 0.75% expense ratio.

The First Trust NASDAQ Cybersecurity ETF (CIBR) began on July 7, 2015, to track the Nasdaq CTA Cybersecurity Index.

This index includes securities of companies classified as “cybersecurity” companies by the Commodity Trading Advisors organization. It has $5.8 billion in assets and an even lower 0.60% expense ratio.

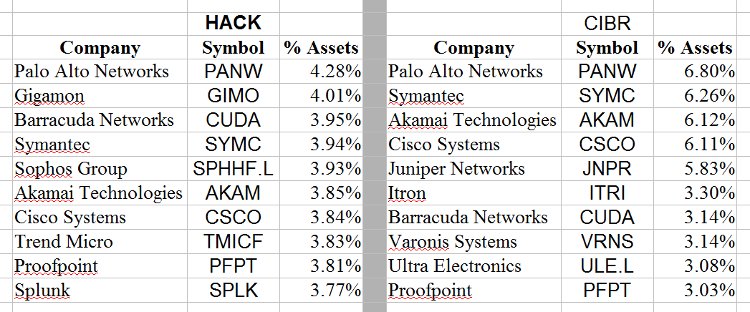

The two funds have similar portfolios, although CIBR is more concentrated:

CIBR also has had better performance. HACK was up 3.2% in 2016 and is up 10.6% year-to-date. CIBR was up 10,9% in 2016 and is up 9.1% year-to-date.

I think they’ll both make you substantial profits over the next three years. I’m going to recommend that you take a full position in the First Trust NASDAQ Cybersecurity ETF under $23 for a three- to five-year hold.