For much of the past two months, the equity market has been engaged in a bout of flirtation with what I’ve called the “reflation trade”, explains fund expert Jim Woods, editor of the Weekly ETF Report.

During reflationary periods, bond yields rise as they reflect investor expectations for future economic growth and inflation.

Also during reflation, we tend to see market sectors linked to economic growth, i.e. banks and financials, industrials, consumer discretionary and small-caps, make a concerted move to the upside.

In mid-October, the reflation trade wobbled a bit, as we saw bond yields fall and bank stocks slide from their recent highs. Yet the recent trend of rising bond yields and rising bank stock prices tells us that the reflation trade is still largely in place. For that trade to continue, I think we will need to see a couple things happen.

First, we need to see more inflation. Second, we need to see material progress on tax reform. The question then for investors becomes: What’s the best way to position your money to take advantage of a continued reflation trade? I think we can look to three exchange-traded funds that will position your capital to take advantage of the reflation trade.

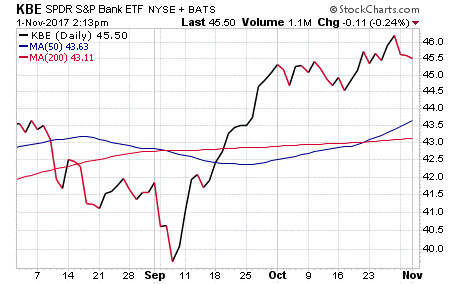

SPDR S&P Bank ETF (KBE)

Bank stocks likely will be the biggest beneficiaries of the reflation trade, and that means having exposure to the segment via an ETF pegged to bank stocks will make sense.

The SPDR S&P Bank ETF seeks to provide investment results, before fees and expenses, that correspond generally to the total return performance of the S&P Banks Select Industry Index.

KBE shares have spiked nearly 12% since the September lows, a move that supports the reflation-trade thesis and that augurs well for a continued move higher in the segment.

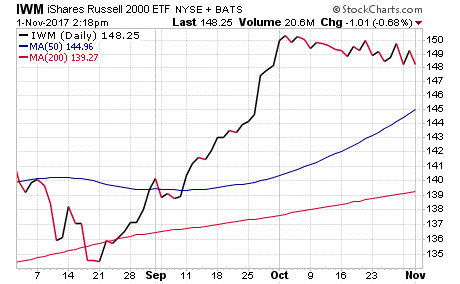

iShares Russell 2000 ETF (IWM)

The return of the reflation trade will be good for small-cap stocks, as these are the stocks most affected by a rising economic tide. Fortunately, gaining exposure to small caps is easy via the iShares Russell 2000 ETF.

This ETF is pegged to the fate of the Russell 2000 Index. Since falling to its recent low in late August, IWM is up nearly 10%. Once again, the rise is another confirmation sign of the reflation trade in action.

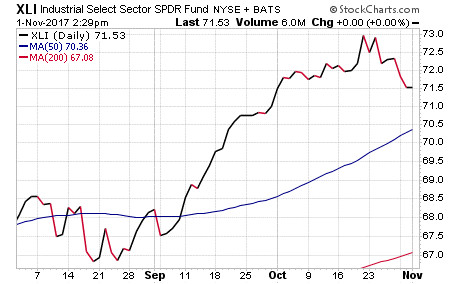

Industrial Select Sector SPDR Fund (XLI)

Industrial stocks also will be big beneficiaries of the reflation trade, and that means you’ll want to consider exposure to the Industrial Select Sector SPDR Fund.

This fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Industrial Select Sector Index.

Since the September emergence of the reflation trade, XLI is up about 4.5% (from its Sept. 5 low). And while the gains have come off their October highs, a continued reflation trade will likely lift this high-flying sector back to new highs.