Oil companies typically come into favor in mid-December and remain so until late April or early May in the following year, notes seasonal trading expert Jeffrey Hirsch, editor of Stock Trader's Almanac.

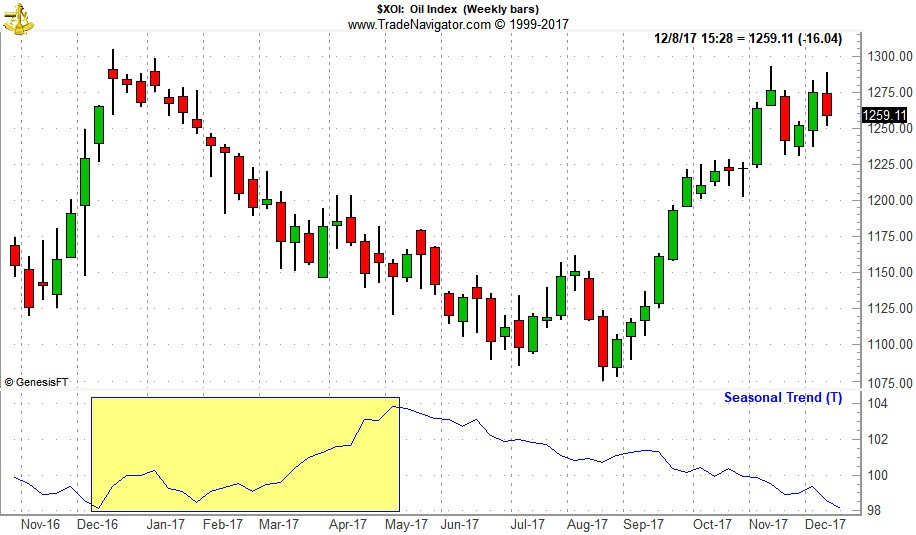

You can see this seasonal pattern in the yellow box in the chart below. This trade has averaged 11.8%, 8.0%, and 9.5% gains over the last 15-, 10-, and 5-year periods.

This seasonality is not based upon the commodity itself; rather it is based upon NYSE ARCA Oil & Gas index (XOI). This price-weighted index is composed of major companies that explore for and produce oil and gas.

Crude oil and XOI have been rallying since September on OPEC/Russian supply cuts and improving global growth prospects.

Normally during this time the opposite is true as demand is generally waning as the summer driving season has ended and the run up to the winter heating season (a buildup in inventories ahead of anticipated demand) is largely complete.

Strength during a typically weak timeframe generally carries over and amplifies gains during seasonally favorable periods.

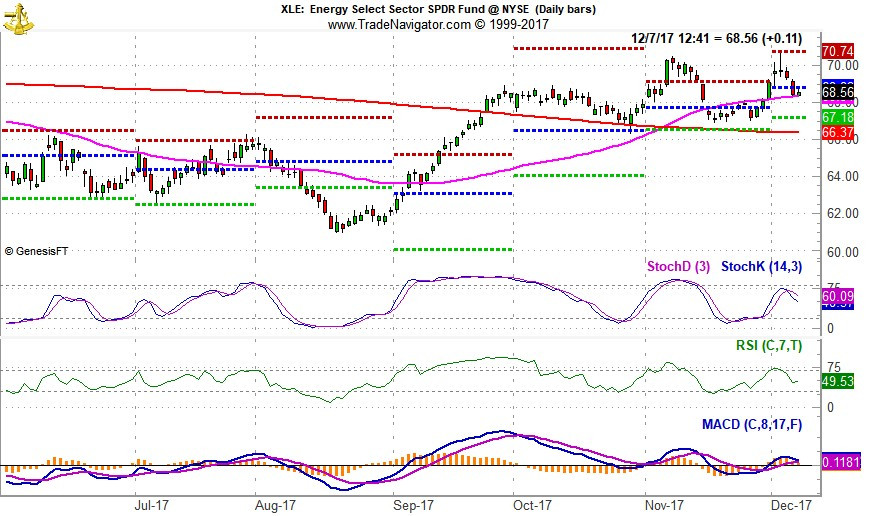

SPDR Energy (XLE) is the top pick to trade this seasonality. A new position in XLE could be established on pullbacks with a buy limit of $67.75. Employ a stop loss of $64.50. Take profits at the auto sell of $83.32.

Exxon Mobil (XOM) is the top holding in XLE at 23.25%. The remaining top five holdings of XLE are Chevron (CVX), Schlumberger (SLB), ConocoPhillips (COP) and EOG Resources (EOG).

Subscribe to Jeffrey Hirsch's Stock Trader's Almanac here…