Sir John Templeton, noted stock picker and creator of the Templeton Funds, once said, “The four most expensive words in the English language are, "This time it’s different," asserts Jim Stack, money manager, market historian and editor of InvesTech Research.

For many investors, that certainly rings true when looking back at past market tops or dangerous bubbles. The propensity to extrapolate bull market gains by justifying extreme valuations and ignoring warning flags is simply too strong to resist.

And the aftermath of the subsequent bear market in such instances can be devastating to one’s portfolio. In that same light, we would add our nomination for the single most dangerous word on Wall Street:

US factories closed out 2017 with a boom – Associated Press, 1/3/18

Trump era ignites badly needed boom in business investment – MarketWatch, 1/30/18

Where the current economic boom ranks in American history – CNNMoney, 1/30/18

Dow Jones tops 26,000 for first time as stock market boom continues – The Guardian, 1/16/18

We wrote about this “boom” headline phenomenon in 2000 and 2007 — near the last two major cyclical peaks in the stock market. The word never appears in the media during the early-to-mid stages of an economic recovery when consumers are digging their way out of the hole from the previous recession, and businesses are skeptical about the future.

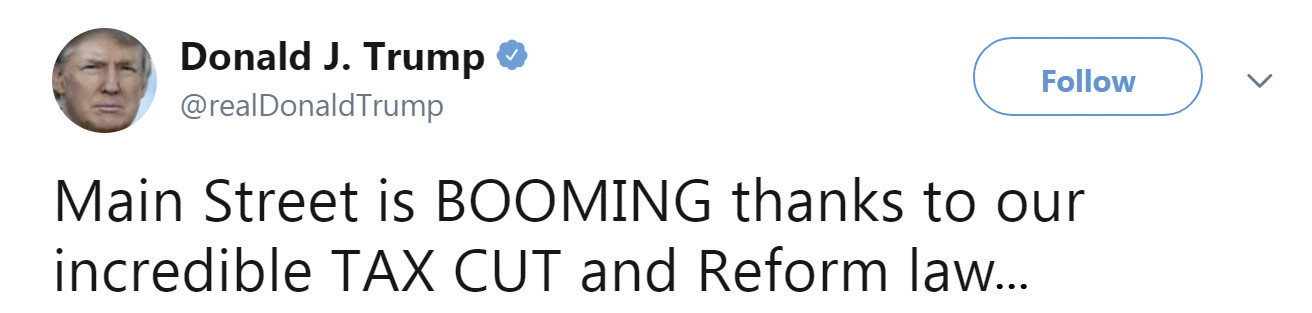

No… it only appears when storm clouds have disappeared and economic skies are bluest. And ironically, it was reemphasized in one of the President’s latest tweets:

Here, we provide the historical evidence that reveals the danger which exists when this word starts appearing in the headlines. While it is not an exact timing tool, and can have an occasional miscue, there are definitive reasons why the psychology behind the word “boom” is a warning flag.

A “booming” economy generally makes most investors feel comfortable — even exuberant! Yet, in an aging economic recovery and in a mature bull market cycle, extremes in optimism can serve as a warning flag for tougher times ahead.

Past peaks in the economy and the market have frequently been marked by the emergence of the optimistic word “BOOM” in the media. And while history doesn’t always repeat itself , it often rhymes … which is why we have long considered this word to be one of the most dangerous on Wall Street.

Let’s step back into the final quarter of 1968, when the U.S. was in the midst of the longest economic expansion (at the time) in its history. No one could see trouble looming for the market or the economy. Yet the appearance of “BOOM” headlines also coincided with an overheating economy that soon led to unexpected upside interest rate surprises … and the 1969-70 bear market.

Over 45 years ago, then economist and future Chairman of the Federal Reserve, Alan Greenspan infamously noted, “It is very rare that you can be as unqualifiedly bullish as you can now.” That was January 1973. Soon after his infamous announcement came the media headlines that contained the menacing word, “BOOM.”

Remarkably, less than five years following the last market peak, the start of the biggest, nastiest bear market since the 1930s was once again coincident with the appearance of these optimistic statements in the press.

Technical warning flags had already been waving from breadth, bellwether, and leadership gauges, but were largely ignored. Unfortunately, most investors relied on economists’ soothing “guarantees” that a recession (and bear market) were not imaginable in such a favorable economic climate.

The biggest headline we have found appeared on the cover of Business Week magazine in February 2000, shortly before the peak of the Tech Bubble. The size of the “BOOM” in this special report appropriately matched the following bear market, which ultimately became the largest since the 1930s.

This cover exemplified the psychological mood of the market peak and was also relaying the message that an overheating economy would force the Federal Reserve to unexpectedly accelerate the tightening cycle. In fact, two additional rate hikes occurred shortly thereafter, poking the fatal pinhole in this excessive market bubble.

In the economic expansion which ensued after the Tech Bubble burst, “BOOM” headlines first appeared at a preliminary market peak in 2006, a full year before the final bull market high.

They resurfaced again just prior to the market top, this time on the cover of Fortune magazine to the tune of “The Greatest Economic Boom Ever”. As in past bull markets, extremes in investor and consumer optimism along with exuberant headlines accompanied this cyclical peak.

It is important to remember that the unique relationship between “BOOM” headlines and market tops is not a foolproof technical indicator. It does, however, stress the importance of increasing emphasis on risk management when making investment decisions at this juncture of the market cycle.