The investments world has complained for month after month about the straight up stock market that won't give us a chance to buy more on a correction, explains technical expert John Strebler, editor of Dow Theory Letters.

Last month, the market obliged, falling an amazing 12% (3200 Dow points!) in just two weeks. The question on most people's minds now is quite simply: is that all? Put differently, with stocks bouncing back nicely and the NASDAQ even making new all-time highs, was that two-week drop the entire correction, such that we're up, up, and away! Again?

We're all weighing in on this, in different ways. We likely won't know the answer for awhile yet. A decline below 23,400 by the Industrials, along with other key stock indices falling below their February lows, would mean the correction is still on.

A rise above 26,600 by the Industrials, with other key indices rallying above their January highs, would mean the correction is over. One or the other of those two scenarios could happen in the course of a few days, but it's more likely that we won't see this issue resolved for several weeks or perhaps even longer.

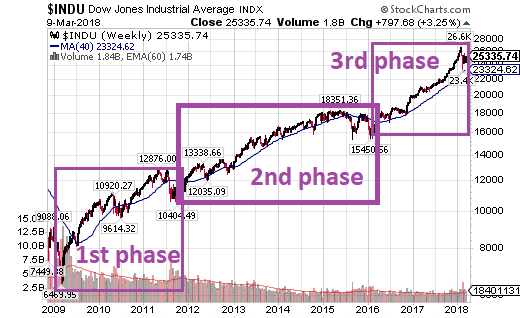

Meanwhile, I'm checking out a few opposing stock sectors, looking for clues about where things are headed. A key assumption is that we are in the third phase of a bull market, the final stage that is characterized by accelerating price increases that take stocks well above their reasonable values as investor psychology becomes unrealistically positive.

This next chart shows how I, at least, have identified this bull market's different phases. If this chart is correct, then this bull's third phase started two years ago.

Which stock sectors typically do the best in the last phase of a bull market? And which are defensive sectors, with stocks that investors buy for upcoming recessions? One of the normally strong ones is small-cap stocks, which we've been suggesting for several months now, and which is represented below by the Vanguard Small-Cap Value ETF (VBR).

VBR didn't make new highs last week, as the tech-heavy NASDAQ did, but it's hard to be disappointed with this chart. As of last Friday, VBR was 64% higher than its price of January, 2016, and a challenge of its all-time highs looks like a good possibility.

Consider the tech-heavy NASDAQ itself, via the PowerShares QQQ ETF (QQQ) with tech issues themselves being a good sector for late-bull market performance. QQQ is obviously a crowd pleaser, up 88% since early-2016, not to mention the new all-time highs.

One more sector often mentioned for late-bull markets is raw materials. SPDR Materials Select Sector (XLB) is that sector's largest ETF, and includes the metals that we've recommended, but also chemicals, paper, concrete, and all kinds of other primary products.

Since a feature of third phase bull markets is an acceleration in overall prices, then the materials that go into making everything naturally rise at that time. XLB's chart is similar to VBR's, in that it is in a nice upward channel, up 75% between early-2016 and last Friday, and poised for a possible run at all-time highs.

Okay, now how about some of the defensive sectors, the ones that savvy investors would be slipping into if the market was anticipating a recession somewhere ahead? The SPDR Consumer Staples Select Sector ETF (XLP) follows consumer staples stocks, sellers of the things people still need to buy even in hard times.

As might be expected, these defensive stocks didn't rise as much in the speculative third phase, with XLP up only 32% in the last two years. Its chart looks positive, but no better than the others we examined. XLP shows no real sign that the pros think it's time to get defensive on this market.

Another market area well known for its defensive nature is the utilities sector, which SPDR Utilities Select Sector ETF (XLU) tracks. People gotta pay their heating and air-conditioning bills, so utilities are a pretty safe bet in hard times. Inflation and interest rates also tend to fall in recessionary times, and utilities tend to be highly leveraged and interest rate sensitive.

That makes utilities doubly good bets at bull market tops. But XLU doesn't look like it's running away on the upside; certainly not as much as the others. Once again, the smart money doesn't seem to be rushing into this defensive sector.

Finally, look at the gold and silver miners, since they're still maybe, kinda considered defensive issues. The Gold & Silver Index (XAU), which we use to follow those stocks and, well – yuck. Not a great picture. The "defensive" gold and silver mining shares are just nowhere, to technicians, so they're no help in answering the critical question we started out with.

Overall, at least for the purposes of this inquiry, we have to say that the charts support the continuation of this third phase bull market. The aggressive small-cap, tech, and materials sectors are strong, while the defensive consumer staples, utilities, and gold mining sectors are certainly no stronger.

All in all, then, this little exercise tells us to hang onto our stocks, barring a change of key indicators and declines below the February lows.