The PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio ETF (PDBC) is, in the management’s own words, an “actively managed exchange-traded fund (ETF) that invests in commodity-linked futures and other financial instruments that provide exposure to some of the world’s most heavily traded commodities.”

PDBC is the sister fund of PowerShares DB Commodity Index Tracking Fund (DBC). Both funds are managed by Invesco PowerShares, a longtime professional investment management firm with a total of 155 ETFs under its watch.

With $1.11 billion assets under management, PDBC is dwarfed in size by DBC and its $2.68 billion in assets. But PDBC charges a much smaller fee (expense ratio of 0.59% vs. 0.85%), while also paying out a distribution yield of 3.86%. PDBC trades in strong volume with small spreads and offers excellent underlying liquidity.

The fund is structured in a way for investors to avoid filing the K-1 tax form, which often can be much higher than the 15% or 20% long-term capital gains rate for dividends. The specifics will vary from investor to investor, so it’s important to do your own research before you attempt to take advantage of PDBC’s tax structure.

PDBC tracks the DBIQ Optimum Yield Diversified Commodity Index (DBIQ), which is 55% invested in energy, 23% in agriculture, 13% in industrial metals and 10% in precious metals. All in all, PDBC provides investors with diversified commodities exposure and a portfolio hedge against inflation.

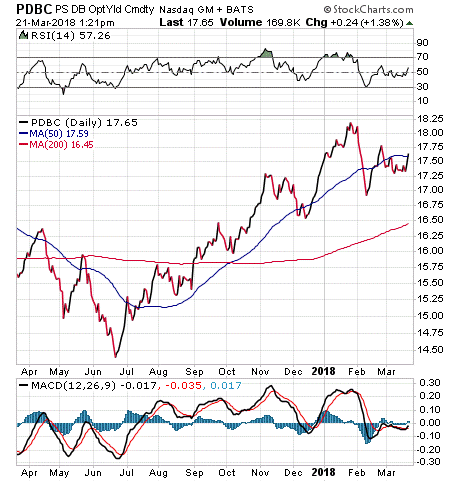

It uses a sophisticated formula to maximize the yield of its portfolio and provide long-term capital appreciation. Year to date, the fund is down 0.46%, but over the last year it has returned 5.28%, as you can see in the chart.

PDBC’s top commodity holdings are WTI Crude, 4.41%; Brent Crude, 4.16%; NY Harbor ULSD, 3.93%; Gasoline, 3.87%; and Gold, 2.64%.

For advanced investors who are seeking a play on the commodities market, I encourage you to look into the PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio ETF.