Municipal bonds are off to a slow start in 2018 - which is usually a bullish sign for these tax-free payers, explains Brett Owens, income expert and editor of Contrarian Outlook.

We last "pounded the table" on munis in December 2016. They were coming off their worst month since the Great Recession. Turns out that was the bottom in munis. And on cue, they rallied for 12 months.

These bonds are back in the doghouse today, thanks to several headwinds. "Ticking time bomb" is a scary phrase tossed around with munis. The story goes that state and local government have pension obligations they won't be able to pay someday. But income-hungry investors are picking up tax-free nickels on the train tracks in the meantime.

Historically, munis have actually been the safest bonds you could have purchased this side of U.S. Treasuries. While we read about the disasters in financial headlines, the reality is that very few of these loans tend to default. Muni bonds have averaged default rates below 0.2% for decades.

But 0.2% isn't quite zero, so I wouldn't buy a basket of munis cobbled together by a dumb computer algorithm. Pensions are a potential concern that needs to be evaluated on a case-by-case basis.

We need a smart muni manager who can curate a portfolio that's safe from credit risk with yields worth our while (which I define as 5%+ and Federal tax exempt). This is doable — and we can even get our management fee comped if we buy right.

Munis sold off on the heels of the 2016 presidential election because investors mistakenly worried that lower individual tax rates would hurt demand for munis.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

While rates have come down, they're still quite high for high earners. For example, a 6% tax-free yield from Nuveen's AMT-Free Municipal Credit Income Fund (NVG) is the equivalent of a 10.2% income stream for someone in the top bracket.

Tax-free income is still attractive, and demand for munis should remain strong. But will they be able to generate the income levels we've seen in the past?

All of the muni funds we discuss use leverage. If they didn't, they wouldn't be able to distribute 5%+ yearly yields. For example, NVG's average coupon today earns it 3.9% in tax-free annual income. The fund then borrows money for 1.1% and buys more bonds to boost its portfolio's yield to 5.4%.

You and I, meanwhile, can buy NVG for just 91 cents on the dollar today (thanks to its price's current 9% discount to its NAV). Which boosts our yield to 6% (which is before we consider tax advantages).

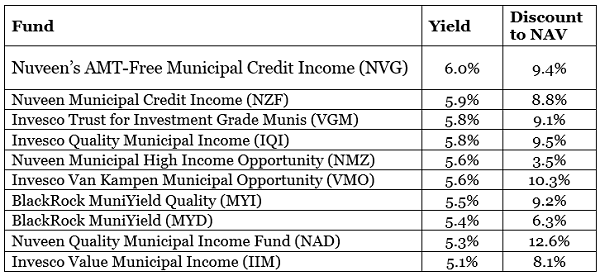

Muni funds in general seem to be fairly priced here. Discounts are on the generous side, up to 12.6% amongst my favorites. This margin of safety is appropriate given the potential for more expensive borrowing costs. Here's my top 10 muni funds.

Each fund:

- Has a market cap above $600 million,

- Pays a 5%+ Federal tax-free yield,

- Pays its distributions monthly,

- Trades at a discount to its NAV (net asset value, the market value of its muni bonds), and

- Has generated 6%+ returns on its NAV since inception.

When it comes to muni funds, past performance is usually the best indicator of future results.

Notice a pattern? It's no coincidence that Nuveen, Invesco and BlackRock dominate the muni leaderboard. These firms have an "unfair advantage" over their competitors and especially over any individual money managers or investors who want to buy munis directly.

Simply put, they get the first phone call. These guys are buying bonds (and securing bargains) that you and I (and even bigger players) never get access to.

Fortunately, we can bridge this gap of unfairness simply by purchasing these funds. And since they trade at discounts to the value of their holdings, we can actually get our management fee "comped" with a free money kicker to boot.