Early last year, tough talk about drug price controls from the fledgling Trump administration sent Bristol-Myers Squibb (BMY) all the way down to $45, which wasn’t even 16X earnings expectations at the time, recalls Todd Shaver, growth stock expert and editor of BullMarket.com.

For a company that rarely moves below a 22X multiple, that decline just wasn’t justified or sustainable. Within weeks, the stock was back above $56, rallying 27% in the process once it became clear that political pressure was illusory and drug sales were more robust than anyone expected.

Instead of stalling, Bristol-Myers was still growing the bottom line at a healthy 7% rate. Since then, both earnings and growth have improved. This is now a company that can confidently deliver $3.40 a year in profit and boost that cash flow 13% over 2017 levels in the process.

And this isn’t just a matter of management squeezing margins or reducing the float to pretend the company is expanding. We’re seeing sales improve quarter after quarter, and when you’re dealing with an enterprise on this scale, that upward drift has already turned into $3.6 billion in revenue that just wasn’t here in early 2017.

This stock is now less-highly valued on a fundamental basis than it was when the world was braced for sweeping drug price rollbacks. The only factor that’s shifted this year is the growth curve, which has only cooled 1% through 2020, which is as far out as we really care to run the models with any real confidence.

This still leaves us with a company that’s growing revenue as fast as it was last year, when this was a $69 stock. And the whole argument revolves around Bristol-Myers losing its dominant position in the ultra-competitive cancer therapy market, which we don’t think is going to happen.

The top contenders in immune-based replacements for conventional chemotherapy are Bristol-Myers with Opdivo and Merck (MRK) with Keytruda.

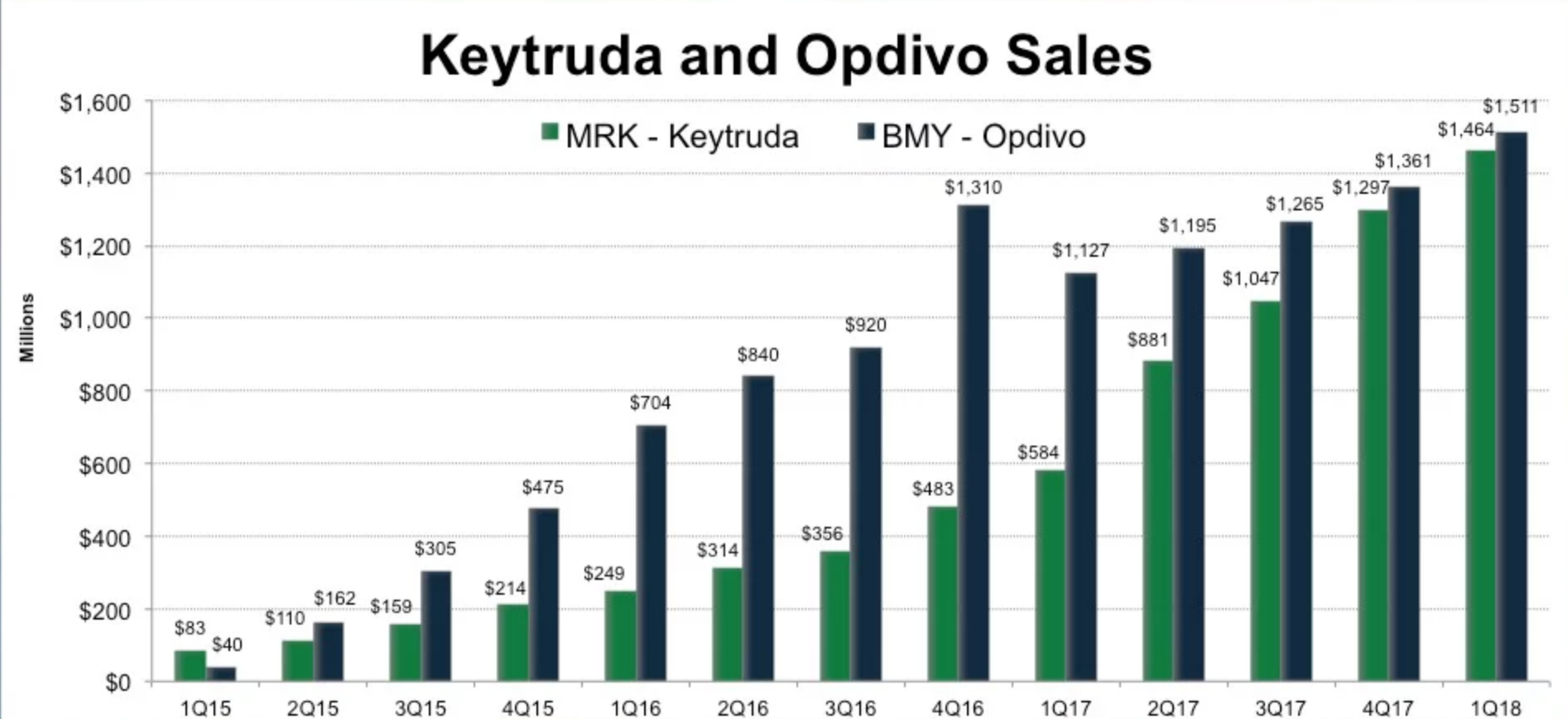

Keytruda was approved earlier than Opdivo but took more time to attract prescriptions outside a limited range of cancer patients. Opdivo, on the other hand, started late and ramped up faster. Exactly a year ago, Bristol-Myers was booking almost twice Merck sales in a head-to-head race.

Opdivo simply works better. Doctors appreciate the added range of effectiveness and prescribe it more often and Bristol-Myers made more money in the process. In the last four quarters, they booked $5.3 billion in sales here versus Merck’s $4.7 billion.

Since then, Merck has gambled its future on expanding the range of tumor types that Keytruda can treat in order to get out from under the Bristol-Myers shadow. They’re the ones on the defensive.

Meanwhile, Bristol-Myers has had its share of successes in melanoma, kidney cancer and other areas, but it's also taken a few clinical setbacks. The successes have been rewarded. The setbacks have been punished.

But the successes still count when it comes to evaluating Bristol-Myers’ future oncology sales. At worst, every incremental point Merck scores lowers the growth curve on Opdivo without taking away the leading position the drug has already built.

Every setback Bristol-Myers suffers (like this weekend’s news that its collaboration with a smaller drug developer “only” cures 50% of all patients with aggressive melanoma) gives Merck another season to keep fighting. With 15 ongoing Opdivo trials, we're going to see a lot of success. Otherwise, management would have pulled the programs early to save a lot of money and time.

At the end of the day, it’s all about sales, not the speculation that surrounds clinical progress. We know for a fact that Opdivo beats Keytruda in open competition when both therapies address the same specific cancer type. If Keytruda can cure people whose tumors resist Opdivo, that’s a good thing for Merck but it doesn’t affect Bristol-Myers either way.

There’s room in the world for two blockbusters, and as Bristol-Myers moves into Keytruda’s territory we’ll see the competitive map change again. Bristol-Myers has built a $6 billion franchise here that demands more than a little respect. Hang in there. History shows that this is a rare buying opportunity.