The VanEck Vectors Investment Grade Floating Rate ETF (FLTR) tracks an index of U.S. dollar-denominated, investment-grade floating-rate notes issued by corporations, explains Jim Woods, editor of The Deep Woods.

The fund, with only $568 million in assets under management, is much smaller than its peers among floating rate funds. In addition, FLTR is more tilted towards debt with lower credit ratings by design, and many of its bonds are often in the BBB to A- investment grade range. Yet, its yield of 3.04% somewhat offsets that risk.

Morningstar classifies FLTR as an "Ultrashort Bond ETF", because it almost exclusively holds bonds with a duration of less than one year. With Treasury yields hitting seven-year highs and more Fed rate hikes on the horizon, FLTR could be an effective tool for fixed-income investors to counter the trend.

Since FLTR adjusts with rising rates, it gives investors the ability to adapt to the current economic environment. In a statement, VanEck, which manages FLTR, said that as short-term interest rates have climbed, short-term fixed-rate bonds have lagged floating-rate notes.

Yields on floating-rate notes are comparable to fixed-rate short-term bond yields, but with much lower interest rate duration. In addition, floating-rate note coupons reset quarterly, adjusting automatically with rates while maintaining a near-zero duration profile, according to VanEck.

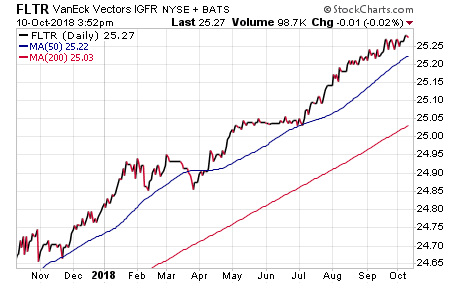

FLTR’s one-month return is 0.24%. Year to date, the fund has returned 2.08%. The fund has a relatively low expense ratio of just 0.14% and pays a monthly distribution. FLTR nearly doubled its distribution going from 2017 to 2018. Its last distribution was paid out on Oct. 5 in the amount of $0.0586, and its next distribution date is on Oct. 31.

FLTR’s holdings are mostly in U.S. corporations. As of Sept. 30, U.S. corporate bonds make up 60% of the fund’s holdings and the next highest exposures by country are Japan, 8.61%; United Kingdom, 6.63%; Australia, 5.65%; and Canada, 4.22%. Top holdings include AT&T, 2.01% of assets; Morgan Stanley, 1.67%; Goldman Sachs, 1.43%; Citigroup, 1.13%; and Wells Fargo, 1.13%.

Investors seeking an inexpensive play in the floating-rate bonds field can consider VanEck Vectors Investment Grade Floating Rate ETF as a potential candidate.