The market right now is telling us to step aside and hold cash. For how long, we don’t know, but what we do know is that unlike the past decade or so, “cash” and cash equivalents now are actually paying something, asserts Jim Woods, editor of Successful ETF Investing.

According to the website Bankrate.com, as of Nov. 15, the average interest rate on a money market account is 0.18%. That’s certainly not very much. However, according to Bankrate’s weekly survey of institutions, some banks are offering 10 times that average or even more.

Bankrate has a list of the top-yielding money market accounts, which all pay 2.25% APY (annual percentage yield). The institutions offering these yields are Investors Bank, Citizens Access and Customers Bank. Now, you may not have access to these money market accounts via your brokerage, and you certainly aren’t likely to have them in your 401(k).

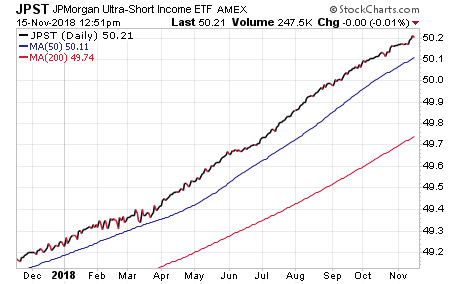

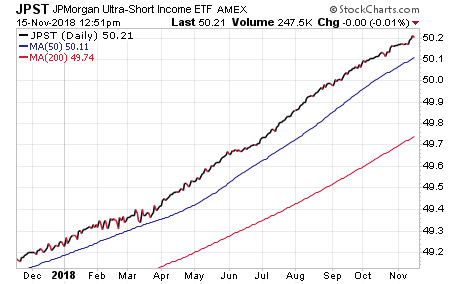

However, there are some great ETF alternatives to cash that you should check out. Three such funds I like are the Invesco BulletShares 2018 Corporate Bond ETF (BSCI), JPMorgan Ultra-Short Income ETF (JPST) and the iShares iBonds Dec 2019 Term Corporate ETF (IBDK).

Each of these money market funds allow investors to allocate “to cash” while also getting a lot more yield than what your brokerage firm might be offering. BSCI is paying a yield of 1.80%, while JPST offers a yield of 1.92%.

IBDK sports the best yield of the bunch, paying some 1.97%. These money market ETFs are all very liquid, and each is a great alternative to cash even if we end up being in cash for only a short time longer.

When it comes to markets, you owe it to yourself as your own fiduciary to maximize your gains wherever they might be, and certainly the ultra-low-risk money market funds listed here are a great way to get that little extra alpha in your account while you wait out the current market storm.