I want to introduce you to what just might be the smartest “smart beta” strategy I’ve come across yet; the Cambria Core Equity ETF (CCOR) is the closest thing to a sophisticated hedge fund in the ETF space I’ve ever seen, explains Nicholas Vardy, editor of Oxford Wealth Accelerator.

Cambria Core combines several complex strategies to generate consistent gains while tightly controlling risk across a wide range of market conditions.

Both its strategy and real-world performance make it a worthy competitor to some of the most sophisticated hedge funds on the planet. Let’s examine how Cambria Core achieves all this.

First, 80% of the value of the fund’s net assets is invested in high-quality U.S. stocks across all industries and sectors.

Second, the fund sells exchange-traded index put and call options. This reduces volatility and increases returns independent of the direction of the broader U.S. equity market. (If you are an options trader, you’ll recognize this as the “Iron Condor” strategy.)

Finally, the fund buys index put options. This protects it from significant short-term market declines.

It’s tough enough to describe all this, let alone implement it in real time. Yet Cambria Core has done just that. The results speak for themselves…

This strategy shines the most when markets are the most difficult.

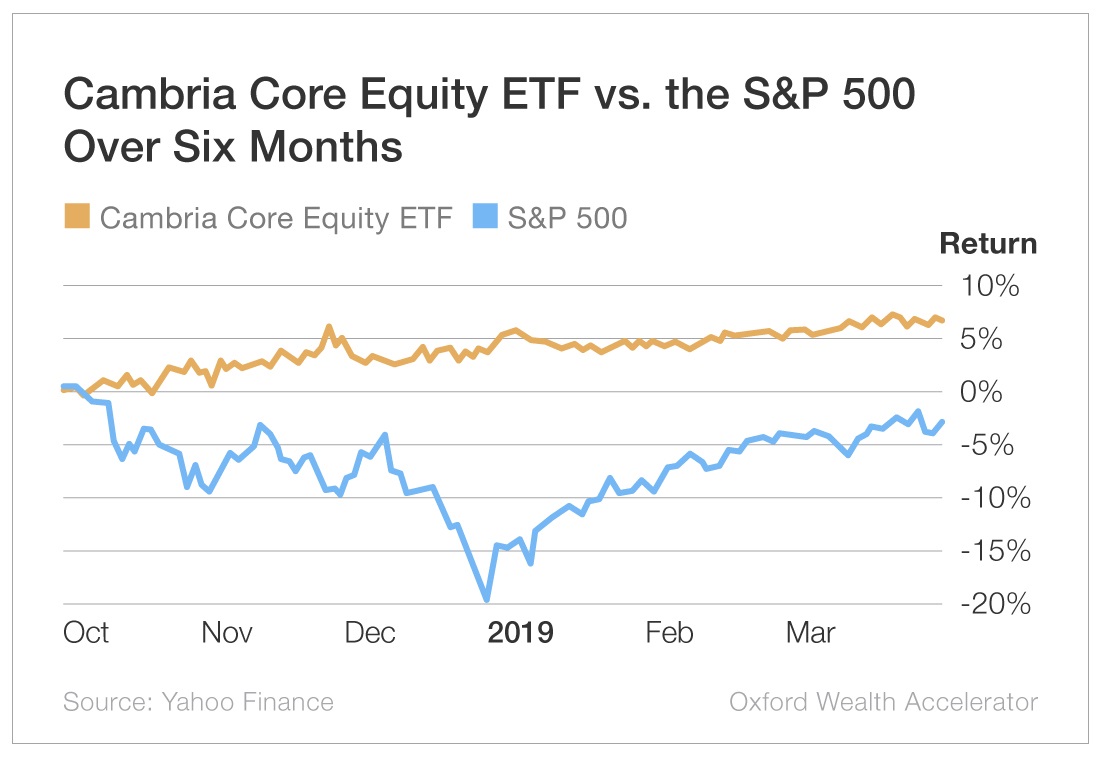

Just consider that over the last three months of 2018 – some of the toughest trading conditions I’ve ever seen – Cambria Core outperformed the S&P 500 by an astonishing 19%!

With the recent V-shaped recovery of the U.S. stock markets, Cambria Core has trailed the broader market this year. And you can expect Cambria Core’s strategy to underperform during bullish phases of the market like the one we’ve seen since January.

It’s important to understand that Cambria Core’s role in the Strategic Portfolio is to stabilize your overall returns during the inevitable downturns.

So if you are worried about protecting your assets during choppy markets. The Cambria Core Equity ETF is a worthy addition to the Strategic Portfolio.