The price of oil has plummeted, and energy stocks have been hammered. Oil prices may go lower, but if you believe that oil prices will be substantially higher a year from now, you should consider buying at these depressed prices, notes Tony Sagami, editor of Weiss Ratings Daily Briefing.

But I’m not talking about buying oil and gas producers; I’m taking about going to the source and getting in on frontier markets.

Now, I know you’ve heard of emerging markets, and perhaps you even invested in them. But frontier markets are made of countries even less established than emerging markets.

The MSCI Frontier Index is composed of 29 countries: Argentina, Bahrain, Bangladesh, Burkina Faso, Benin, Croatia, Estonia, Guinea-Bissau, Ivory Coast, Jordan, Kenya, Kuwait, Lebanon, Lithuania, Kazakhstan, Mauritius, Mali, Morocco, Niger, Nigeria, Oman, Romania, Serbia, Senegal, Slovenia, Sri Lanka, Togo, Tunisia and Vietnam.

Frontier markets are small; real small. The market cap of all the stock of those 29 countries is only 0.3% of the global total. For perspective, the market cap of emerging markets — such as Brazil and China — is 8.8% of the global total.

But don’t be mistaken:

While frontier markets are small, the opportunity they hold is not. And there are four main opportunities you should be aware of ...

1. Natural Resources

Africa is a leading producer of diamonds, sugar, salt, lumber, gold, iron, cocoa beans, cobalt, uranium, copper, bauxite, silver and oil. Other frontier market countries are big oil producers, such as Kuwait, Bahrain, Nigeria, Kazakhstan and Oman.

2. Emerging Middle Class

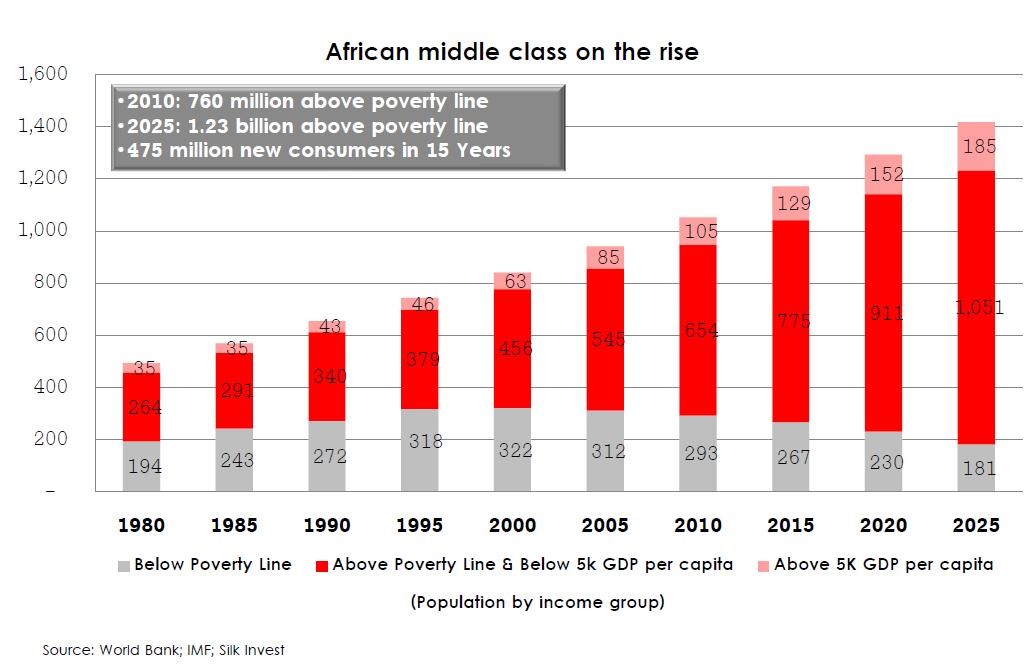

Also housed within Africa is a rapidly growing middle class; it doubled in the past two decades to 313 million people. This rapid growth can be seen across frontier markets. That translates into consumers with money to spend.

3. Population Growth

Frontier markets are also expected to see substantial population growth overall. Looking at Africa as an example again, its population is expected to double by 2050, according to the Bill and Melinda Gates Foundation. This means a rapidly expanding workforce.

4. Diversification

Frontier markets have a low correlation to developed markets. The MSCI Frontier Market Index has a low 59% correlation with the S&P 500. This allows investors to take advantage of the previously stated opportunities while introducing a layer of diversification to their portfolios.

Considering all the above, frontier markets are certainly not without risk. In fact, they are often riskier than developed markets: They can be politicaly unstable, have poor liquidity, have questionable financial and account reporting and can see large currency fluctuations.

However, I believe that there are huge profits to be made in frontier markets if you have a high enough risk tolerance. If you do, I encourage long-term investors to include a modest allocation to them.

If you are an ETF investor and are interested in frontier markets, there are two ETFs you should look at iShares MSCI Frontier 100 (FM) and Global X Next Emerging & Frontier (EMFM).