It’s rare to find one stock that has it all. Well, here’s one that has size, safety, yield and growth: Wheaton Precious Metals (WPM), asserts Peter Krauth, editor of Silver Stock Investor.

With a market cap of USD $19 billion, Wheaton Precious Metals is the second largest precious metals royalty and streaming company in the world. Royalty and streaming companies provide funding for mining projects. In return, they receive a portion of the miner’s revenue or metal output at a discount from the spot price.

This business is so efficient, the largest gold royalty/streaming companies boast revenues per employee of over $20 million annually in 2020. By comparison, Newmont (NEM) and Barrick (GOLD), the two largest gold producers, generated “just” $634,000 and $692,000 per employee. This is likely the most lucrative business model ever.

In my view, exposure to precious metals is essential over the next several years. With inflation at 40-year highs and interest rates near historic lows, you will lose 5% yearly on a ten-year U.S. Treasury bond paying just 1.8%.

This is the ideal environment for gold and silver to outperform stocks and bonds. But silver is also an industrial metal that’s irreplaceable in many applications. With the global shift to green energy and electrification, silver’s demand from solar panels, electric vehicles, wind power and high-tech electronics is soaring, while supply can’t keep pace.

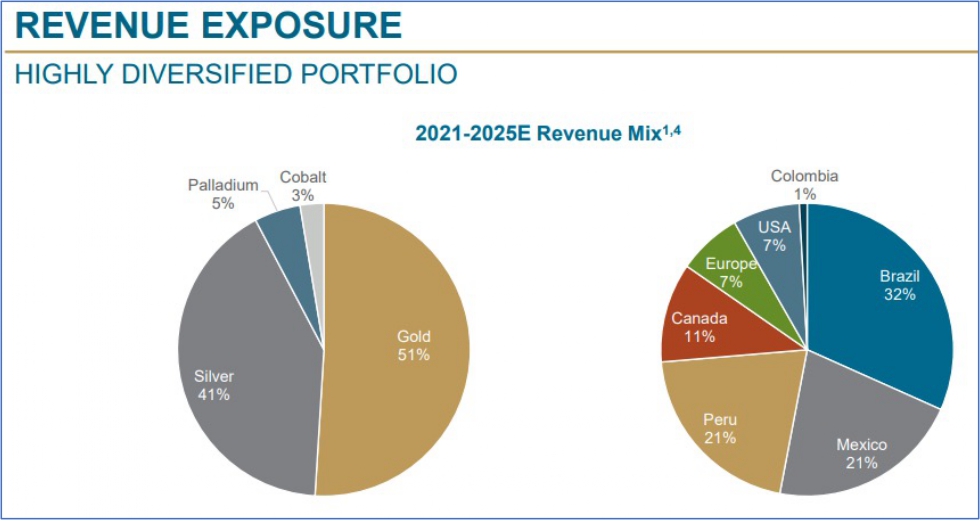

In 2020, silver represented 36% of WPM’s revenues, while gold was 60% and palladium 4%. At slightly more than one third, WPM has the highest silver revenue profile among streaming and royalty companies. But silver will grow to 41% of revenue over the next 5 years, while geopolitical diversification remains strong.

Source: Wheaton Precious Metals company reports

Based on reserves and resources, Wheaton has over 40 years of mine life remaining. Ninety percent of production is from assets in the lower half of the cost curve. Cash operating margins are 75%.

Higher gold and silver prices will expand those margins even further. A 50% increase in commodity prices will generate a 65% increase in cash flows. The current 1.45% dividend yield is very sustainable, and I believe likely to grow. Management increased it by 30% last March.

Despite Wheaton’s size, production will also grow. That’s because existing streams will increase their output, which directly boosts Wheaton’s production.

In addition, management is still finding new significant growth opportunities. In 2021, the company added two silver, four gold, and one new platinum stream. Wheaton is a "must own" stock for every portfolio, and I think it could well return north of 30% gains in 2022 before dividends. It’s one that I will be watching very closely.