Some of the most profitable stock buys are those with temporary bad news that is likely to get much better before long. The negative press induces people into selling at low prices, often just before they rebound sharply, explains Paul Price, editor of TheStreet's Real Money Pro.

That is almost certainly the case right now with American Woodmark (AMWD). The firm manufactures kitchen cabinets and bathroom vanities for both new construction and the remodeling crowd.

Business is booming as evidenced by all-time high revenues. What is the bad news then? Last year’s lumber price spike caused a severe pinch to profit margins as already ordered merchandise had locked in price points which were set before raw material costs escalated.

AMWD’s large backlog worked against it for that reason. Quarterly results suffered starting with fiscal Q4 of 2021 (ended April 30, 2021) and have got worse over the next two quarters. Management has already instituted a series of price increase but it takes time for them work through to the bottom line.

FY 2021 is going to show significant downward EPS for that reason. Good news is now on the horizon. Management expects the end of January quarter to show some benefits of the early price hikes.

When fiscal Q4 results are released next spring that source alone is projected to add $50 million to revenues. That amount is quite large considering AMWD has less than 17 million shares outstanding.

Over the next 18-months all-time record results appear well within reach, with further progress to follow. Smart traders should be positioning now while the shares are close to their lowest levels since shortly after the covid-panic of 2020.

Stocks like these typically bottom out well before their earnings trough. If you wait for the “good news” you will almost certainly have missed the chance to buy really cheap.

American Woodmark is a volatile name. Since 2014’s nadir there have been four significant rallies and four major set-backs. The declines averaged (-53.7%) over less than six months. That includes the one-month, 70% shock which occurred during the covid-panic.

Subsequent rallies averaged gains that far exceeded the percentage drops. Typical rebounds averaged 186.9% and lasted much longer in duration than the declines, at almost 14-months from start to finish. AMWD’s recent low represented a 44.2% decline from its April 2021 peak of $108.81. The damage has already taken place, setting up the shares for their next solid rebound.

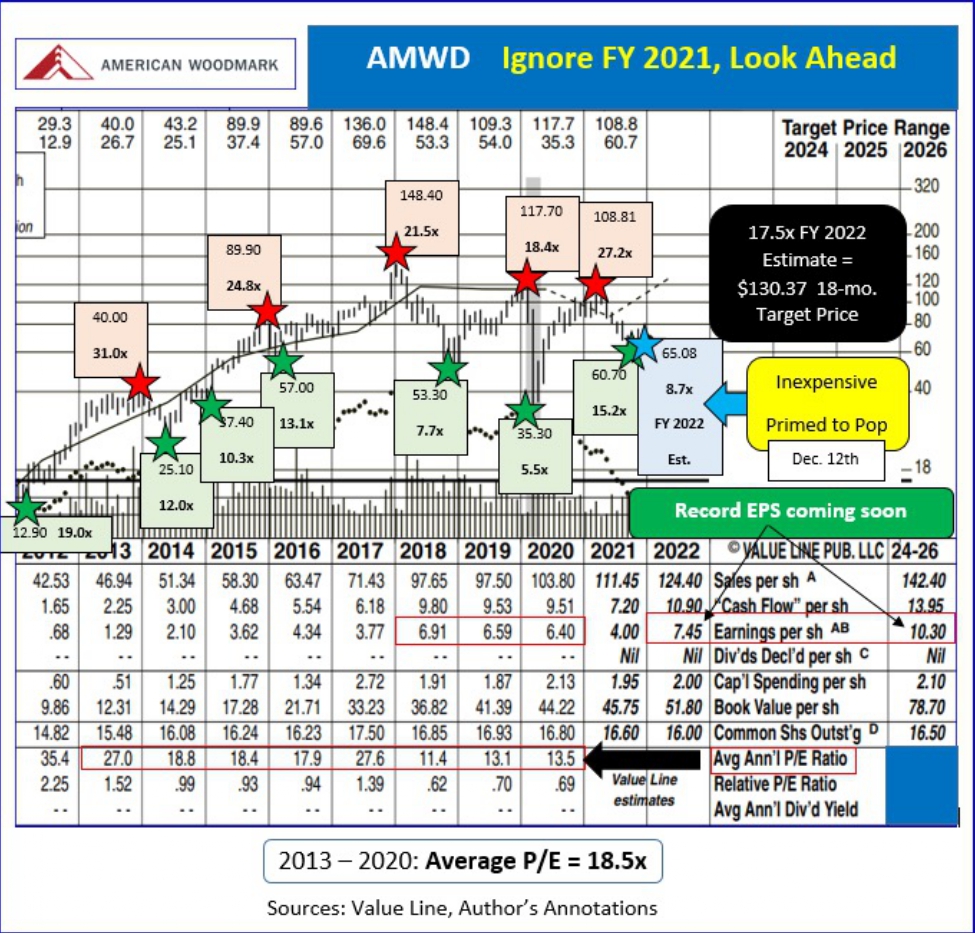

What is AMWD really worth once those improving quarterly results start rolling in? In the eight year period from 2013 through 2020 the stock commanded an average multiple of 18.5-times. All four of the stock’s non-covid related “should have sold moments (red-starred below) saw AMWD top out between 21.5x to 31.0x earnings.

Assume just a 17.5 multiple on FY 2022’s estimate and you come up with an eighteen month target price north of $130. That is almost exactly 100% above AMWD’s current quote. In my world doubling in a year and half is quite an acceptable rate of return.

That goal is far from an upper limit. Note that AMWD peaked between $108 and $148 during each of the last five years including 2021. None of those periods saw EPS reach what is now projected for FY 2022.

Independent research from Morningstar labels the shares as neutral pending better results. They do indicate AMWD’s present-day fair value as $97.50, though. Simply returning to that modest goal would deliver almost 50% from AMWD’s Dec. 12, 2021 price.

Value Line sees EPS surging to $10.30 not later than 2024 – 2026, supporting a 3 to 5 year target price range of $130 - $200. I agree with that general assessment, but don’t believe it will take that long to reach it.

Option writers can play AMWD via sales of naked puts out to July 15, 2022. Almost nobody believes that AMWD has much, if any downside left. There are simply few people willing to bet on a further downturn over the coming eight months. That is borne out by the tiny 1.74% short interest in the stock itself.

If you agree with my take on American Woodmark you certainly should not be deterred in selling some puts. The sell-off since last spring has set reward to risk on AMWD around its best level since the covid-crisis bottom. Buy some shares, sell some puts or consider doing both.

(Disclosure: Paul Price is long AMWD shares, short AMWD options and AMWD is currently one of his largest personal dollar holdings.)