Initial public offerings (IPOs) are few and far between these days, yet they are getting some of the best reception in years. Still, the IPO market alone isn’t a sign that things are overheating, observes Callie Cox, chief market strategist at Ritholtz Wealth Management.

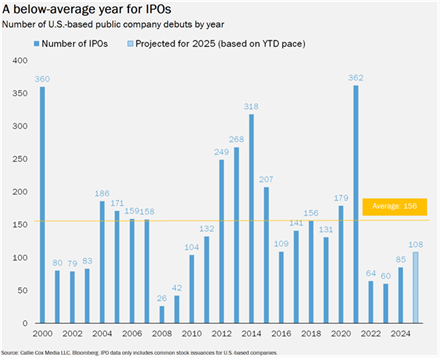

Businesses and consumers may be cutting back on spending, yet investors are throwing caution to the wind to get to know that cute new boy who we’ve never seen around these parts. In 2025, just 62 companies have gone public. At this pace, we may only see 108 IPOs this year, much lower than the average of 156 each year since the beginning of the century.

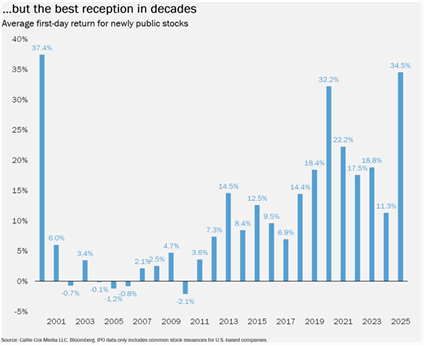

But man oh man, do we love these new kids. Shares of new companies this year have surged an average of 35% in their first day of trading, making 2025 the most successful year for public debuts since at least 2000.

The cool kids haven’t just commanded the cafeteria. They rule the entire school. Analogies aside, you have to wonder what this IPO euphoria tells us about the future of the stock market.

Maybe the investment bankers have it all wrong. They’re constantly underestimating just how hungry America’s investors are for the next big thing. Or maybe there’s more appetite for new ideas because we’re living in this renaissance era of Artificial Intelligence (AI), and the benefits of this freight train of a technology are becoming more obvious by the day.

In the past, we’ve seen companies and investors get overly excited right before the market turned on them. That’s not the case today. You can love all of the new kids without jeopardizing your social status. They’re actually kind of okay, even if Wall Street is giving some side-eye.

That said, be careful, eager IPO investors. A good idea doesn’t always translate into a sustainable business, even if people cheer extra loud on the first day. You can see this in the graveyard of failed companies and ruined stock prices of public offerings past.

Don’t be the kid who peaks in high school. Or the investor who puts it all on the line for the golden-ticket stock that turns into mental torture.