Federal Reserve Chairman Jay Powell’s recent remarks lit a fire under the markets as they represented a dovish pivot on monetary policy. The current high-yield credit environment is flashing bullish signals across the board, which makes NXG Cushing Midstream Energy Fund (SRV) attractive, suggests Bryan Perry, editor of Cash Machine.

Powell signaled a potential interest rate cut in September. The move comes amidst tremendous political pressure from President Trump, but also from a number of economists citing emerging fragility in the labor market.

The Cash Machine model portfolio should perform well as the Fed starts to ease monetary policy. Currently, the high-yield spread over Treasuries sits at 2.94%, down from around 3.2% in mid-May. That’s historically tight, signaling strong investor confidence in credit markets.

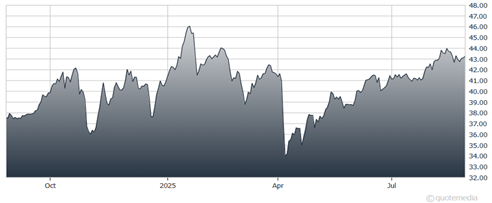

NXG Cushing Midstream Energy Fund (SRV)

Investment-grade spreads are also compressed at 0.77%, reflecting robust demand for corporate debt. Non-levered high-yield bond yields are at 6.74%, offering solid income despite tight spreads. Moody’s reports that the average one-year default probability for high-yield issuers has dropped to 3.4%, reinforcing the narrative of improving credit quality, and fund flows are favoring short-duration, higher-quality junk bond ETFs.

SRV is a non-diversified closed-end fund with an investment objective of high after-tax total return from a combination of capital appreciation and current income. It recently yielded 12.5%.

Recommended Action: Buy SRV.