Nvidia Corp. (NVDA) nearly pulled in $50 billion, but was it enough? The stock fell after the initial release, where revenue came in as expected overall. The company also barely met or missed estimates for data center sales, depending on which analyst you talk to, explains Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

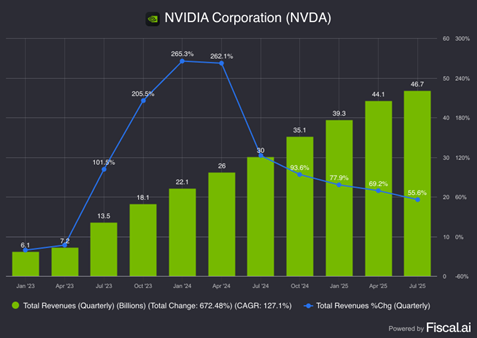

The company pulled in revenue of $46.7 billion, up 56% year-over-year, with adjusted earnings per share of $1.05. The company expects Q3 revenue of $54 billion, plus or minus 2%, estimated at $53.4 billion. If that 2% give or take comes in low, it looks like the company is barely keeping up with expectations.

(Editor’s Note: Tom is speaking at the 2025 MoneyShow Toronto, scheduled for Sept. 12-13. Click HERE to register FREE.)

Data center revenue was $41.1 billion, missing some higher estimates of $41.3 billion. Nvidia did not generate revenue from H20 China sales, despite only receiving the ability to sell the chips in August. CFO commentary noted that the Q3 forward-looking revenue forecast did not include China chip sales.

Nvidia approved a $60 billion buyback, and it’s due to pay out 1 cent per share in dividends on Oct. 2. That’s just in time to buy Halloween candy…or in this case, enough for a single Skittle.

All in all, the company’s nearly $50 billion in revenue looks fantastic. But as Bloomberg analysts pointed out, NVDA is the most highly valued public company. Plus, compared to last year’s 100%-plus jump in revenue, a 56% gain looks paltry for investors demanding more.