We’ve done well in AI-related tech stocks, and here the question is whether it’s January 1999 or March 2000. Meanwhile, I like the content delivery network company Fastly Inc. (FSLY), writes Michael Murphy, editor of New World Investor.

You may remember the Nasdaq strength from 1995, after Netscape went public and shot up 500% in a few months, to 1998. It had all the magazine editors greenlighting stories about how expensive Internet stocks were. All the value stock managers were tearing their hair out or even closing their hedge funds.

Then came 1999, and everything shot up even higher. So, if the present moment is like January 1999, we do not want to get off the bus. Yet.

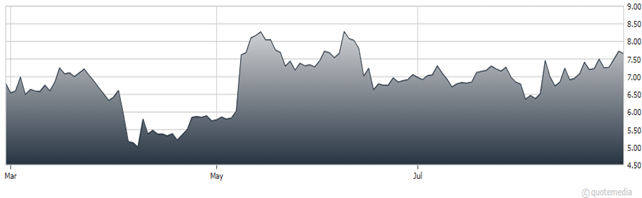

Fastly Inc. (FSLY)

I understand the AI bear case, and they will be right eventually. But I also understand the bull case – the 1999 scenario. Big Tech is in an arms race to dominate AI...and governments worldwide are building sovereign AI data centers.

In the US, former President Biden’s CHIPS Act will provide $280 billion for semiconductor production and supercomputing. President Trump’s AI Action Plan is removing red tape, fast-tracking data center permits, and warning states that noncompliance could cost them federal funding.

As for FSLY, it said analysis of traffic from mid-April to mid-July shows that AI crawlers made up almost 80% of all AI bot traffic observed, with Meta generating more than half and eclipsing both Google and OpenAI combined. Fetcher bots – those that access website content in response to user actions, including those used by ChatGPT and Perplexity – also are driving massive real-time request volumes.

In some cases, fetcher request volume exceeds 39,000 requests per minute. This surge is putting pressure on unprotected origin infrastructure, consuming bandwidth, overwhelming servers, and mimicking the effects of DDoS [Distributed Denial of Service] attacks, even without malicious intent.

North America receives a heavy skew of AI crawler traffic, accounting for nearly 90% of observed activity. Fastly can block the crawlers. FSLY is a Buy under $10 for a three-to-five-year hold.

Recommended Action: Buy FSLY.