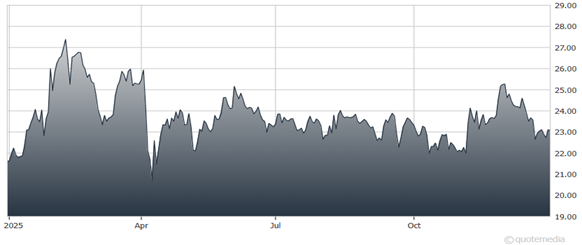

At $24.60 recently, USA Compression Partners LP (USAC) had an indicated annualized yield of 8.5%. We consider USAC a Buy up to $30. This Master Limited Partnership (MLP) is suitable for medium- to high-risk taxable portfolios, suggests Martin Fridson, editor of Forbes/Fridson Income Securities Investor.

For the 12 months ending November 2025, USAC delivered a 14.8% total return, handily outperforming the Alerian MLP Index’s 11.5%. USAC is a third-party provider of compression equipment and services to customers in the domestic oil and gas industry. Its compression equipment gives customers the ability to move natural gas through the domestic pipeline system.

The MLP also provides compression applications that assist in the production of crude oil. Energy Transfer LP (ET) owns the noneconomic general partnership interest in USAC and 46.9% of its outstanding common units.

USA Compression Partners LP (USAC)

Operations focus primarily on high-horsepower applications. These make up more than 75% of USAC’s active compression fleet. The compression fleet is spread over a diverse geographic area, covering five different basins. Those basins enjoy some of the industry’s most favorable economics, displaying resilience during periods of stressed pricing.

In 3Q 2025, USAC beat the analysts’ adjusted EBITDA consensus estimate, posting a record $160 million. Revenue from contract operations revenue rose by 5% year-over-year. In conjunction with the earnings release, USAC raised its full-year EBITDA projection by about 2.5%, exceeding Wall Street expectations at the time. The MLP benefited from a tight market for its compression services, recording a 94% average horsepower utilization rate.

As for USAC’s financial strength, Moody’s long-term corporate family rating stands at Ba3 with a Stable outlook. Standard & Poor’s long-term local issuer rating is B+ with a Stable outlook. On Oct. 28, 2025, Fitch Ratings reaffirmed its BB long-term default rating, maintaining its Stable outlook and deeming USAC’s leverage appropriate for the rating.

Positives cited by the rating agency included the MLP’s size, geographic diversity, strong customer retention history, and long-term relationships with major counterparties. Stable cash flows are a function of 100% fixed-fee, take-or-pay contracts that have no short-term volumetric or commodity price-based revenue risk. Most of the MLP’s revenue derives from large investment-grade counterparties.

Subscribe to Forbes/Fridson Income Securities Investor here...