Costco Wholesale Corp. (COST) is a stock that features a powerful narrative: its substantial, long-term structural advantages are being obscured by investor concerns over immediate sales growth. It offers compelling value because the market is failing to appreciate the true scale of its opportunity, suggests Joe Markman, editor at Digital Creators & Consumers.

Costco is sitting on a massive, multi-year physical footprint opportunity. Accelerating demographic tailwinds should define the company’s next decade of growth.

We view the company as a premium subscription service that generates revenue from the sale of bulk goods. In fiscal year 2025, the company delivered strong results with $269.9 billion in net sales, up 8.1% year-over-year. This financial strength is underpinned by an exceptional 91% membership renewal rate. Subscriptions are a stable, high-margin, recurring revenue stream.

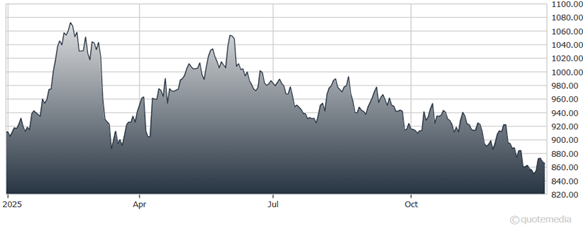

Costco Wholesale Corp. (COST)

However, the critical opportunity being missed by investors is the scope of Costco's underleveraged footprint. The company operates only 914 warehouses globally. This pales in comparison to competitors. For instance, Walmart Inc. (WMT) has over 10,750 locations.

This vast disparity highlights the significant white space available for expansion, particularly as the company targets affluent, suburban shoppers. Management plans 35 new warehouses in fiscal 2026. This acceleration in store openings is perfectly aligned with the swelling of affluent suburbs globally.

Digital growth further compounds this advantage. E-commerce sales surged by 27% in 2024, driven by big-ticket items fulfilled through Costco Logistics. Executives forecast returns on equity near 32%. The Costco story is about buying a high-quality subscription business with a massive, de-risked expansion runway at a standard retail valuation.

Recommended Action: Buy COST.