AbbVie Inc. (ABBV) is a US-based biopharmaceutical company formed in 2013 as a spinoff from Abbott Laboratories (ABT). It’s a cutting-edge company with strong exposure to high-demand needs in immunology and oncology...and it has a terrific pipeline, maintains Tom Hutchinson, editor of Cabot Dividend Investor.

AbbVie became an industry giant because of its mega-blockbuster drug Humira. It’s an autoimmune medication that became the world’s bestselling drug with annual sales of over $20 billion. But the tremendous success of that drug became a problem as Humira lost its patent overseas a few years ago, and it lost its US patent in 2023.

Because of shrinking Humira sales, AbbVie posted lower year-over-year revenues until late last year. But the company turned that corner. AbbVie has long planned for this eventuality and has done a stellar job launching new drugs capable of replacing the diminishing Humira revenue.

Abbvie Inc. (ABBV)

Humira accounted for 75% of revenue a few years ago. But new immunology drugs Skyrizi and Rinvoq together now have sales that already replace peak Humira revenues. In the most recent quarter, the two drugs had combined revenue of $6.9 billion, on pace to substantially outsell the best Humira year.

AbbVie has also guided for the two drugs to bring in $31 billion in 2027 and $40 billion by 2029. While those drugs are killing it, AbbVie also has a robust pipeline of new drugs in the hopper, including important cutting-edge indications in the areas of blood cancer and Parkinson’s. In fact, there are currently 20 drugs in phase III, the final phase before approval. AbbVie also currently has over 50 drugs in earlier development phases.

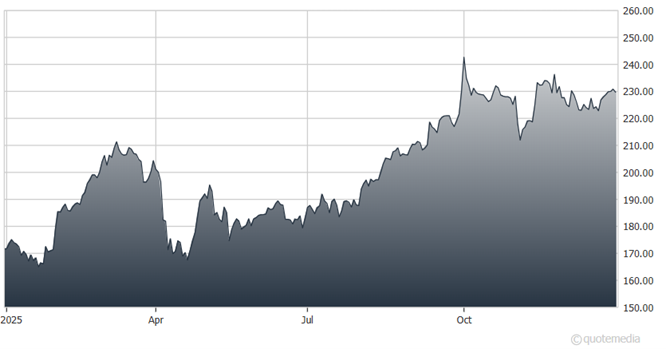

Despite the market-beating performance of the past several years, the stock was held back by the patent issues and falling revenue. Having turned the corner, it looks like better days have already arrived. ABBV was up more than 20% in 2025.

Don’t forget the dividend. The company is paying out $6.92 per year, which translated to a 3.1% yield at the recent price. AbbVie has also grown the dividend by an average of 12.5% per year over the last 10 years and raised the payout annually...including when it was part of Abbott Labs...for 53 years.

Recommended Action: Buy ABBV.