Investors who examine sentiment by consumers and business owners can follow more useful indicators like the VIX and ten-year bond, asserts Don Kaufman, founder of TheoTrade.

On Thursday (April 13), stocks sold off as they headed into the three-day weekend. Stocks finally followed bonds and the VIX, completing the “risk off” trade. The story remains the same in that stocks haven’t reacted to the negative news. Fiscal stimulus isn’t coming soon, monetary tightness is coming soon, and the latest economic data is weak. A 3% sell off in the S&P 500 doesn’t come close to pricing in this weak news considering how expensive stocks were at the all-time highs.

The past few weeks have seen sentiment indicators jump ahead of real economic data. This has led to investors taking a closer look at sentiment data to see if it means anything.

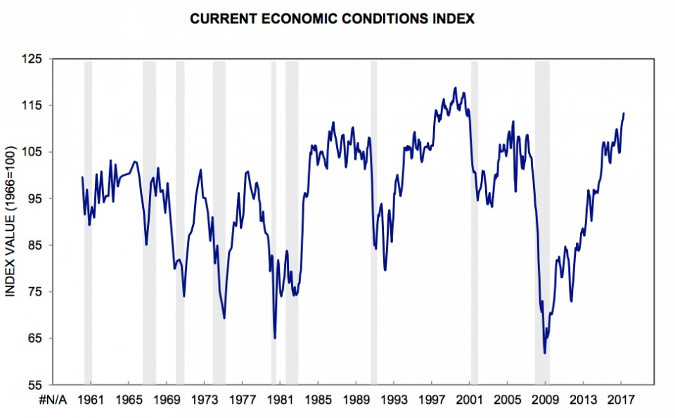

It turns out that consumer sentiment and small business owner sentiment is useless at projecting economic growth. The preliminary reading from the University of Michigan was released on Thursday. The overall index increased from 96.9 in March to 98.0 this month. The current economic conditions index reached 115.2, as you can see in the chart below. That’s the highest rating since 2000. The confidence in 2000 was the highest since the survey was started in 1960. As I said would happen, the partisan divide closed in the latest survey as the expectations index rose 7% for Democrats and fell 7% for Republicans. The divide is still 50.5 points.

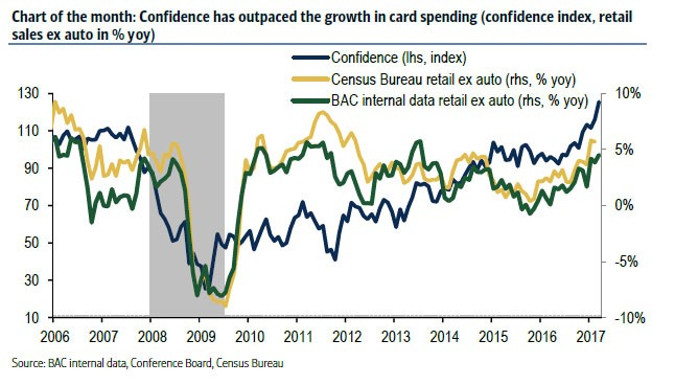

The fact that expectations can be impacted by partisanship proves the consumer confidence index isn’t a reliable indicator. Consumers aren’t going to alter their discretionary spending based on who the president is. The chart gives you a recap of how unreliable the consumer confidence indicator has been. The Bank of America BAC data on retail spending has been relatively consistent in showing low single digit growth, while the confidence index has accelerated higher. Neither the consensus bureau nor Bank of America’s internal data have been correlated with consumer sentiment. It looks like sentiment is based off how long the economy has been growing without a recession hitting.

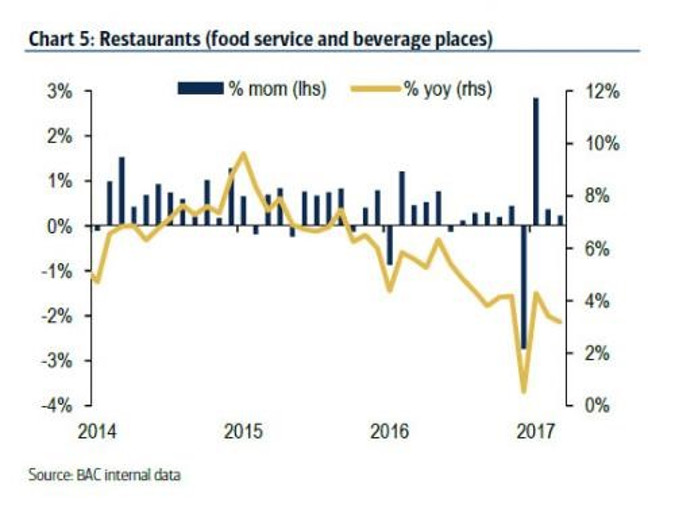

While the current economic conditions index rallies to new heights, the restaurant same-store sales have been decelerating since 2015. Consumer confidence isn’t reliable. Typically declines in restaurant sales have been indicative of a coming recession, but the recession happened yet. The big blip lower in the chart below is because of the winter storm which hit the Northeast.

There’s an interesting trend going on with shopping centers. Malls are expanding their food halls to bring in guests. This makes sense because restaurants are more resistant to online sales than apparel.

Restaurants which are experiences bring traffic to malls. Food takes up 9% of space in malls and is expected to rise to 20% by 2025. This trend in the expansion of food stores in malls such as Eataly in the World Trade Center mall runs counter to the trend shown above.

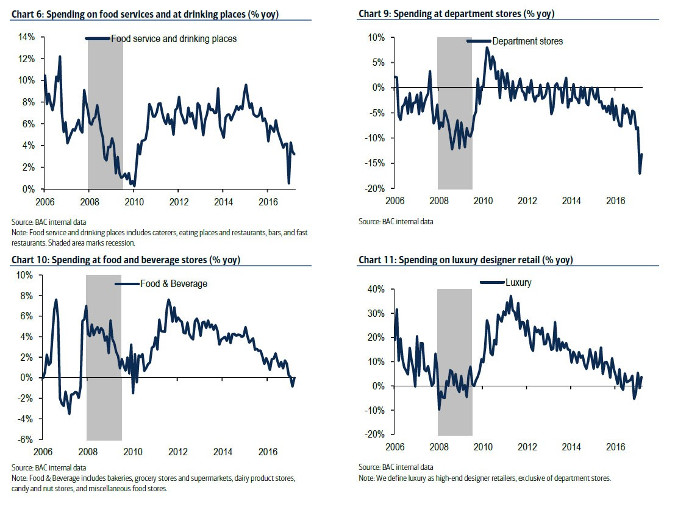

The hypothesis I have on why food stores are gaining market share in malls even though they are weakening is because they are outperforming apparel department stores. Restaurant sales are only weak for cyclical reasons while brick and mortar apparel is in a secular decline as it loses share to online stores.

Another benefit to having restaurants in malls is restaurants take out longer leases than retailers which gives malls more consistent cash flow.

The four charts break down the weakness in the segments of retail. As I said, food and beverage sales are outperforming department stores which have negative year over year sales. Whether Eataly is considered a restaurant or a supermarket, it is likely outperforming most apparel stores. When I have visited the one in NYC, it has always been busy.

Luxury sales have been hurt by the strong dollar as European shoppers stopped buying expensive items when they vacationed to America. If Trump’s attempt to weaken the dollar is successful, luxury may be boosted higher.

The trend of increasing soft data while hard data is moderately weak has been showing itself in the difference between the New York Fed’s GDP model and the Atlanta Fed’s GDP model. The NY Fed’s model is more optimistic since it uses more soft data.

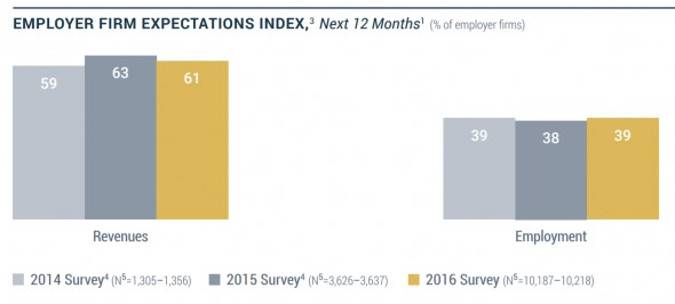

In a twist of irony, the NY Fed did an analysis which proved small business sentiment doesn’t predict their activity. As you can see from the chart below, the small business expectations have been consistently positive on both revenues and employment in the past three years.

Small business owners tend to be optimistic about their business or they wouldn’t have taken the risk necessary to start one.

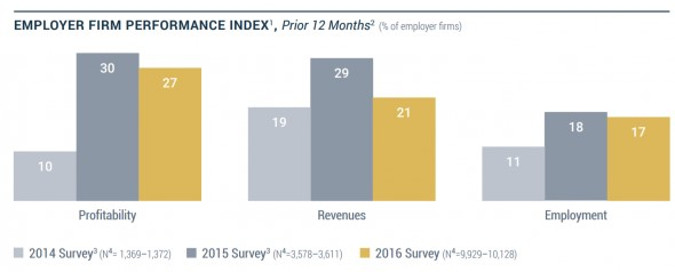

The charts below show the actual results small businesses had in terms of profitability, revenues and employment. Reality was lumpier than their projections. If small businesses can’t even predict their future results, using small business sentiment as an economic indicator seems dubious. It’s possible small business owners are more optimistic in surveys, but they do know how their results will be. It doesn’t matter either way because the only information we have is their sentiment not how they “really feel.”

The NY Fed proved that investors and economists should take the GDP forecast from the Atlanta Fed’s model more seriously than its own model. Usually soft data is in tune with hard data which makes the NY Fed’s model reasonably accurate, but not for this quarter as optimism has occurred because of future potential catalysts which haven’t played out yet.

Conclusion

The soft data has been strong, but that hasn’t translated into strong hard data. There needs to be a fiscal stimulus to drive economic results or the economy will remain stagnant. In this article, I proved that strong consumer sentiment doesn’t lead to improved consumer spending and positive small business sentiment doesn’t lead to improvements in their profitability.

Stocks may be beginning to realize that growth is sagging in Q1 as they have fallen 3%. It’s still a far cry from where they can fall to if a recession occurs. The VIX and the ten-year bond seem to be signaling economic weakness is about to occur. Restaurant sales are weak even though they are resistant to the online sales trend.