Andrea Kramer, analyst with Schaeffer's Investment Research, takes a look at the performance of the S&P 500 Index (SPX) over President Donald Trump's 100 days in office — and assesses the roughly 5% gain achieved and expectations for more gains ahead.

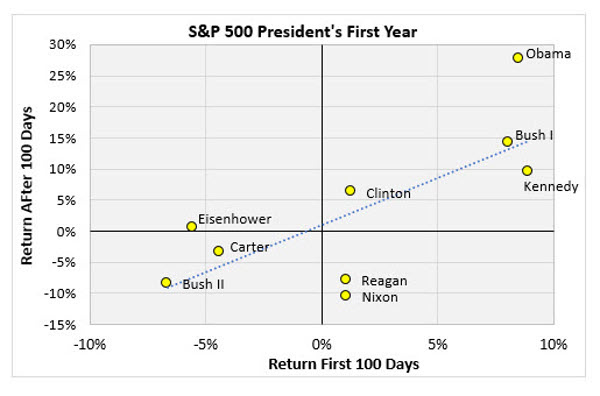

Below, we'll take a look at how the S&P 500 Index (SPX) has fared during this stretch, compared to other presidents' first 100 days in office. We'll also examine what stocks' price action during a president's first 100 days could mean for the market through the rest of the year, and when stocks have historically peaked post-100 days.

As of last Thursday's close, the SPX was up 5.17% since Trump's inauguration -- a healthy return, though not as impressive as his predecessor, who took office just two months before the March 2009 bottom.

Also, Presidents Kennedy and Bush Sr. saw bigger SPX gains in their first 100 days, according to data from Schaeffer's Senior Quantitative Analyst Rocky White.

Given the S&P's gain of just over 5% in Trump's first 100 days of office, the scatter plot below suggests the index could yield a return of close to 9% for the rest of the year. While impressive in its own right, it would arrive fourth behind Obama, Bush Sr., and Kennedy, respectively.

Nevertheless, the SPX hit a closing high during Trump's first 100 days in office -- most recently on March 1, when the index settled at 2,395.96 -- and came within a chip-shot of here earlier this week ahead of Wednesday's release of the White House tax reform plan.

There have been only two other occurrences when the S&P hit a record high closing high during this time span, namely under Kennedy (Jan. 27, 1961) and President Clinton (Feb. 1, 1993).

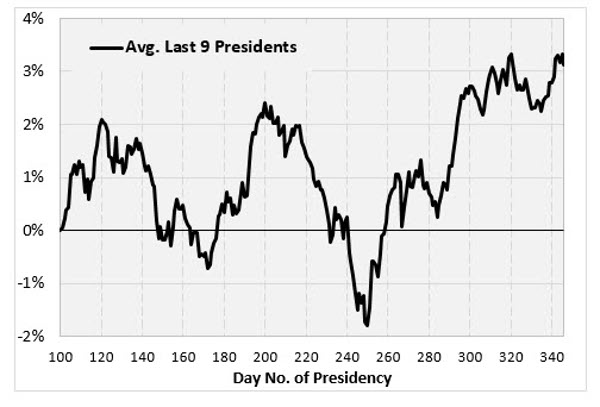

After averaging the rest-of-year returns of the last nine presidents beginning at day 100, we can estimate that stocks tend to peak around day 120 -- which would be May 19, this year -- and bottom around day 170, or July 8th.

The S&P goes on to peak again around day 200, or Aug. 7, and bottom on day 250, or Sept. 26. More broadly speaking, the S&P has historically been choppy during a president's first year in office, averaging a post-inauguration gain of 3.1% since Eisenhower.