The short-term decline in April has ended. The Nasdaq, S&P 500 and Russell 2000 all successfully tested key support levels this past week, observes technical expert Bonnie Gortler in Signalert Asset Management's Systems & Forecasts.

The recent news of possible tax cuts sooner rather than later, an optimistic perceived outcome to the election in Europe, and a good start to the earning season has spurred a potential new leg of the advance.

Overhead resistance on some indices exists. However, the Nasdaq 100 (QQQ) has made a new high, has broken through resistance giving new upside projections, which could carry the overall market higher for the next several months.

More time is needed to know if other averages will follow suit or if the present rally will fizzle. However my prediction is there is more room to the upside.

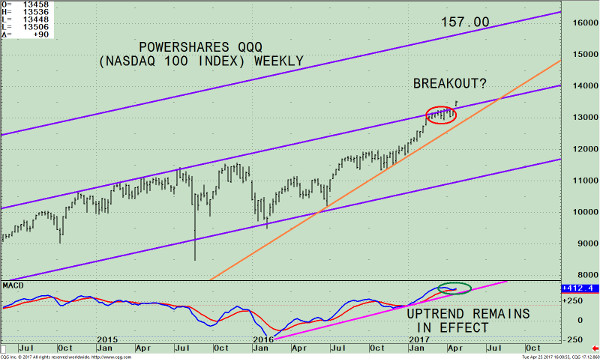

The top part of the chart shows the weekly Power Shares 100 (QQQ), an exchange-traded fund based on the Nasdaq 100 Index and its operative trend channel. The QQQ includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq stock market based on market capitalization.

As of 04/24/17, Apple (AAPL) is the largest holding comprising 11.84%; Microsoft (MSFT) 8.20%, Amazon (AMZN) 6.80%, Facebook, Inc. Class A (FB) 5.38%, Alphabet Inc. Class C (GOOG) 4.70%, and Alphabet Inc. Class A (GOOGL), 4.10% totaling 41.02%.

The QQQ has been rock solid this year, leading in relative strength vs. the S&P 500, and up almost twice the gains of the S&P 500. The QQQ has slightly penetrated the middle channel after a 9-week consolidation, where the QQQ traded between 129.38 and 134.00 (the red circle), now trading at 135.14.

The bullish outcome is not a surprise. The next upside target is 157.00, a 16.2% gain from present levels. The intermediate trend remains up as long as the QQQ remains above the up trendline line (orange).

Because the initial upside thrust since the election was so strong, the expectation the first decline wouldn’t be significant is exactly what has occurred. The present breakout needs to be watched closer. Keep an eye on how Apple (AAPL) performs, the largest holding of QQQ.

If the Nasdaq continues to show leadership, making new highs, then it could support the market and help the technology sector over the next several months.

On the other hand, if the QQQ falls below 129.00, retracing its recent gains, a warning sign of a potential change of trend would be given. If the QQQ falls below 125.00 breaking the uptrend, (orange line) more caution would be warranted with possibly a larger correction on the horizon than the decline in April.

The bottom half of the chart is MACD (12, 26, 9), a measure of momentum. It was a bullish MACD pattern that confirmed the price high made in QQQ in February 2017, before the recent consolidation.

The uptrend remains in effect (pink-line). The QQQ has made a new high. If MACD turns down failing to make a new high, a negative divergence would occur. Over the next several weeks watch to see if MACD makes a higher high.

This would be bullish. If MACD turns down, this would complete the negative divergence pattern and would be considered bearish.

Summing Up:

Our models remain overall neutral-positive for the intermediate term which means upside potential remains greater than downside risk. Technology stocks continue to lead the market higher.

After many weeks of consolidation and weakening momentum, the Nasdaq 100 (QQQ) has broken through resistance giving new upside projections to 157.00 which could carry the overall market higher for the next several months.

The advance seems to be broadening. Market breadth is improving, financials and small caps have come to life again gaining in relative strength. These are all signs of a healthy market. The intermediate uptrend in Nasdaq (QQQ) price and in MACD is intact.

If the uptrend is broken on either price or MACD more caution will be necessary, as the odds would increase the advance will fizzle and no longer sizzle. For now, the bulls remain in control, continue to enjoy the ride.