China’s reflation, which started in 2015, continues and has been peaking with nominal GDP up 12 percent year over year in the first quarter. That’s the highest level in five years, asserts Yiannis Mostrous, editor of Capitalist Times.

Paying attention to nominal growth numbers is important, because companies report sales and profits in nominal terms. Note that inflation doesn’t seem to be an issue for the China’s central bank with CPI at just 0.9 percent for March.

A look at economic performance implies overall strength. Industrial profits are up 32 percent year over year in the first two months of 2017. The size and breadth of this number bodes well for the potential of a corporate investment cycle.

Manufacturing investment rose by 7 percent, retail sales were up 11 percent in March and urban job creation was at 3 million for the first quarter.

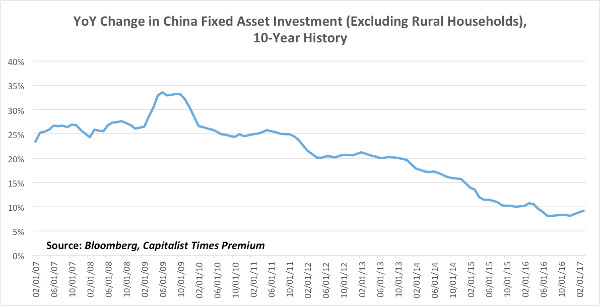

Fixed-asset investment (FAI) was up 9.5 percent in March, indicating once more that the investment cycle in China remains robust. And this is one of the main reasons we expect China’s GDP to be between 6.5 to 7 percent again this year.

The longer-term big bet is for the supply-side reforms to continue. This is driven by the authorities’ efforts to close capacity, especially for steel and coal.

At least 20 million tons of steel capacity is to go away this year in China. This shift will be gradual, and the efforts should be continuously evaluated as data is released.

For now, China’s strong momentum should guide you to allocate funds in the China market. Be aware, however, that corrections are common during a strong market and geopolitical developments could change the outlook quickly. Overall, focus on finance and technology.

In finance, banks, insurance companies and brokers have positive momentum, good valuations and specific upside catalysts -– improving profitability, progress on bond issuance and initial public offerings, and upward earnings revisions.

The best way to gain exposure to Chinese financials is through Global X China Financials (CHIX), which rates buy up to $15.

As for technology, intrepid investors should consider Global X NASDAQ China Technology (QQQC), which rates a buy up to $25 per share.