Option traders should be on the lookout if the semiconductor ETF SMH trades near the $150-$152 level, asserts John Person, a 36-year trading veteran who has written several books and featured speaker.

Is there ever a time when stocks just trade one way, up? No, but some technology stocks have been on fire in 2017 with semiconductors leading the way.

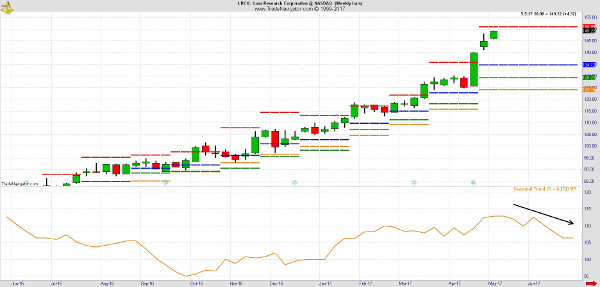

Last year’s darling was Nvdia (NVDA) and this year is Lam Research (LRCX) along with Micro Chip Technologies (MCHP). We all eventually find out stocks that go one way, straight up, tend to see sharp corrections.

So is this time different? The month of May started off with a strong surge in technology with Lam Research trading 3% higher on the first day of the month. That’s on top of a 35% gain since the beginning of 2017 and over a 260% return in five years.

What helped propel this stock higher, besides positive earnings, was back on April 20 the company reported a stellar buyback program to repurchase $500 million of the company’s common stock as part of a $1 billion agreement to be completed within 12 -18 months from its announcement date made on November 18, 2016. Its next earnings report will be in July.

Will this trend of continued gains continue?

From a seasonal perspective, the Semiconductor sector, VanEck Vectors Semiconductor ETF (SMH), tends to peak out in late May. And with this stock’s last surge, it leaves itself vulnerable for a profit taking correction as it closes in on longer term price resistance target levels.

One such indicator that I use is the Persons Pivot analysis. Option traders should be on the lookout if the stock trades near the $150-$152 level. Due to a low Implied Volatility environment, one can take advantage of a potential correction ahead of the stocks earnings report and the seasonal weakness for the sector.

The current price is at $149.22; with a bit more upside, traders could take advantage of a defined risk Options strategy, namely a vertical Bear Put Spread. This is a simple strategy that entails buying a $150 Strike Put Option while simultaneously selling a $145 strike Put Option, paying a price difference of $2.00.

The maximum gain on June 16 expiration if the stock declines back under $145 would be $3.00. The profit is determined by the difference value between the two strike prices, minus the premium paid ($5.00 -$2.00 = $3.00).

If the stock sees a mild correction or enters a period of consolidation, asking the stock to trade back near $145 is within the realm of reality, seeing as it was just trading at that level on April 28.

While we all wonder, when will the bull market end, here is a low-risk way to participate in a stock that’s due for a pullback and has a seasonal tendency to peak in late May as the graph below shows.

Subscribe to John Person’s newsletter and education services here...