This is, indeed, a mature economic cycle and potentially the latter stages of the second longest bull market in Wall Street history. By most measures, both consumer and business confidence are at the highest levels in over 12 years, explains Jim Stack, money manager and editor of InvesTech Research.

The confidence on Main Street has turned into exuberance and speculation on Wall Street, as valuations move to more dangerous levels and margin debt soars upward toward all-time highs. Meanwhile, history suggests this market is overdue for a correction.

History shows that 10% corrections come around about every two years (25.9 months), and 5% corrections occur more regularly — every 7.1 months.

It has now been 14.2 months since the most recent correction ended in February of last year. So while recession warning flags appear to be resiliently (and surprisingly) absent, one might say this bull market is getting a bit overdue for the next 5% to 10% correction.

While confidence and optimism provide the fuel for economic growth and a strong stock market, this same fuel can push valuations and speculation to excessive levels, and often leads to market tops.

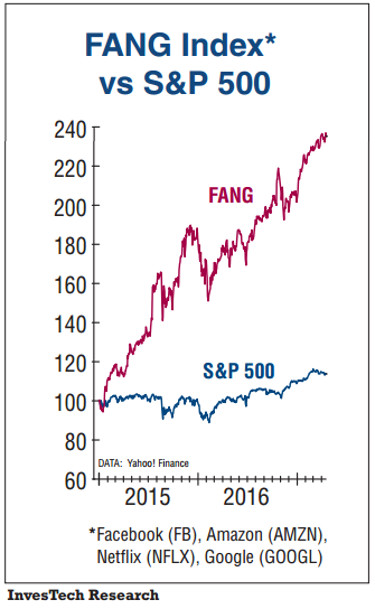

One of the most revealing examples of investors’ increased appetite for risk lies in the “FANG” stocks. This narrow group of technology and consumer stocks — Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOGL) – are considered the leaders in some of the emergent areas of growth in the economy.

Because of their anticipated future potential, these stocks as a group have radically outperformed the S&P 500 since 2015.

The problem lies in the valuation of the stocks, which appears to already be discounting much of the future growth. They trade at a combined P/E ratio of 47.3 based on trailing earnings — nearly twice that of the S&P 500 — which makes them vulnerable to declines.

Facebook was not yet a publicly-traded company in 2011, but the other three components suffered a 37.5% loss in the 2011-2012 correction.

Looking at the 90-year chart of the S&P 500 P/E below, the market has spent only 9% of the time at valuation

levels greater than today, and most of that occurred during the 1990s Tech Bubble and 2008 Financial Crisis.

If one excludes the valuation extremes of the 2007-08 Financial Crisis, the 1990s Tech Bubble, and 1929-31, the Price-to-Earnings Ratio of the S&P 500 Index is in the 99th percentile. In other words, during normal times, valuations have been this extreme less than 1% of the time!

The reason we describe this period as “critical” is because late-stage bull markets can be very luring. It is when

novice investors, who have never invested in stocks, often pile into the market — with money they cannot afford to lose.

And it is also when seasoned investors start to question whether “risk management” is needed anymore.

Between the optimistic headlines and the almost daily new stock market highs, it requires vigilance and a historical discipline to recognize the inherent risk, and to stay focused on watching for bear market warning flags.

Our portfolio is already in a moderately defensive position, with a 16% cash reserve and a balanced allocation that includes the less-cyclical staples and health care sectors. We are willing to sacrifice some potential gain for the increased comfort of safety.

The reason we have not moved to a more defensive or higher cash position — even with current valuation extremes — is that the final six months of a bull market can be surprisingly profitable.

On average, the final six month gain of bull markets since the 1950s has averaged 13.6%… and every instance experienced over an 8% gain.

So we will continue to give this bull market the benefit of doubt. However, we do not intend to overstay our welcome when the fireworks of the next bear market begin.