In his weekly report, Don Kaufman, Co-founder of TheoTrade, asserts that the Fed is raising rates so it has enough ammunition to cut them in the next recession.

In this article, I will discuss the latest reports about the labor market. The three reports we received this week were the ADP report, jobless claims, and BLS non-farm payrolls.

hese positive reports along with the rebound in Apple (AAPL) stock to a new all-time high, caused the Nasdaq and S&P 500 to close at new all-time highs on Friday. As someone who is often skeptical of the rallies, the 0.41% rally in the S&P 500 this week, which brought its year to date gains to 7.17%, made sense to me.

Earnings growth is solid, jobs growth is solid, the Fed is still relatively dovish, and tax reform looks likely to pass. It’s tough to see any near-term headwinds which can cause stocks to have their first 5% correction of the year.

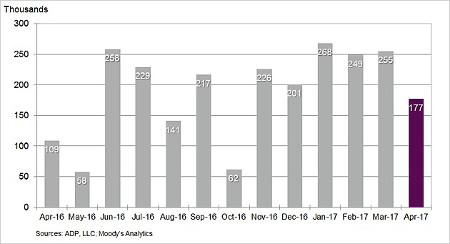

Last month the ADP report was great even though the BLS number showed sharp deceleration due to the excess snow in March. This time it was the ADP report which showed deceleration as private sector payroll growth declined from 255,000 jobs to 177,000 jobs.

I would describe this report as good, but below the twelve-month average. It was led by mid-sized and small firms. Mid-sized firms hired 78,000 workers and small firms hired 61,000 people. There had been a trend where firms with 1,000+ workers were accelerating their hiring growth relative to firms with 20-49 workers, but that trend reversed this time with small businesses doing so well. I’ve also discussed the trend of sentiment indicators not matching up with reality.

The main piece of evidence supporting that claim is the positive consumer sentiment reports and weak consumer spending data this year. On the other hand, the strong NFIB small business sentiment is being reflected in the amount of workers small businesses hired in April.

The BLS non-farm payrolls report beat expectations for 190,000 jobs created in April as the report came in at 211,000 jobs created. The revisions to the prior two months combined were down 6,000. Many were expecting the March number to be revised higher because it was so bad in the initial report, but it was revised lower from 98,000 to 79,000.

The March report is now a distant memory though because of the fantastic April headline number. The worries that a new weak job growth trend was emerging have been dashed.

I would summarize the BLS report’s details as good, but not great. The best detail of the report was that the unemployment rate dropped from 4.5% to 4.4%. This drop was unexpected because economists thought it would make up for the strange decline last month.

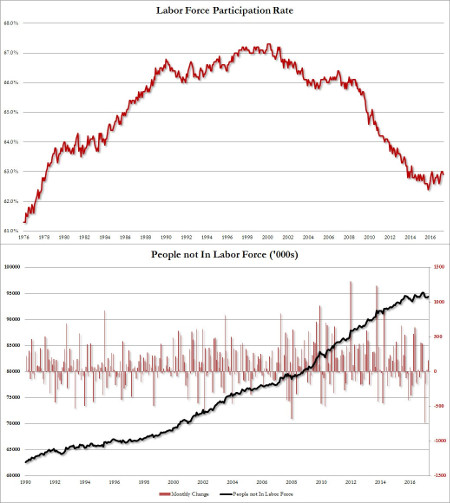

Last month saw a drop in the unemployment rate even though the job growth was weak and the labor participation rate was stagnant. That brings me to the weak parts of the April report. The labor participation rate fell from 63.0% to 62.9%.

As you can see from the chart below, the number of workers not in the labor force increased by 162,000 to 94.475 million which is the highest rate of 2017. This, along with the great headline number, explains why the unemployment rate dropped.

There has been stabilization in the labor participation rate. Some investors claimed this was because the Trump election brought so much optimism that some discouraged workers jumped back into the labor force. This thesis has been hurt slightly by this latest report. If the labor participation rate needs to be dragged a few points higher to eliminate the labor slack, there’s still room to grow without wage inflation getting out of hand.

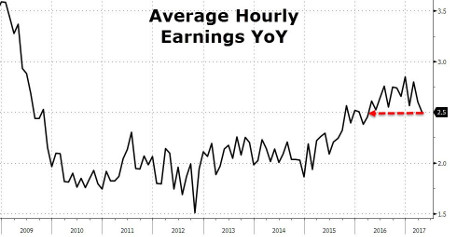

Excess wage inflation still is not close to occurring even though the underemployment rate fell from 8.9% to 8.6%. The average hourly earnings growth month over month hit expectations for 0.3%, but the year over year growth was only 2.5% which was below expectations for 2.7% growth.

The hourly wage growth remains elusive despite the seemingly strong headline numbers. This could be construed as a bright spot for stocks because the weak wage growth is preventing the Fed from hiking quicker.

If the year over year wage growth was 4%, that would be great for workers, but bad for corporations’ margins. The Fed would also hike rakes quicker. Therefore, we may be in a goldilocks scenario if hourly wage growth doesn’t decelerate further.

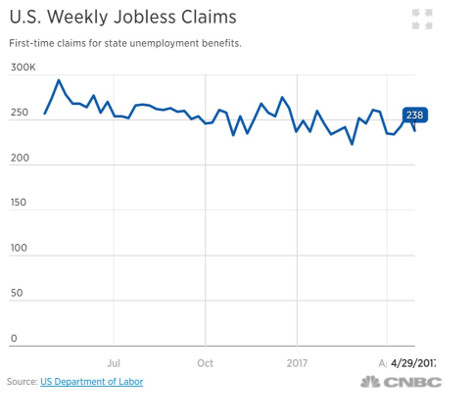

The jobless claims report was much better than expected. It came in at 238,000 which was below the expectations for 247,000 and the prior week’s report which showed 257,000. The decline is being explained by saying the prior reports in April were affected by the timing of Easter.

Now that we’re past the time when Easter falls, the number is more reflective of the strength of the labor market. Continuing jobless claims fell by 23,000 to 1.96 million which is the lowest level since April 2000.

In terms of Fed policy, these three reports mean the Fed will raise rates in June. The current chance of a rate hike is 78.5%. Not much changes with this rate hike because the Fed is still relatively dovish and raising rates slowly.

To give an analogy, I’d say the Fed is driving the car at 30 miles per hour on the highway. Stopping the hikes would be like stopping the car and hiking rates 150 basis points per year would accelerate the car to a normal speed of 60 miles per hour.

This means the Fed would have to stall the hikes or accelerate them in 2018 for the market to react to the Fed.

Conclusion

The labor market is in the sweet spot because jobs are being created at a robust pace, but there’s not enough hourly earnings growth to push the Fed to get more hawkish.

With the latest declines in inflation growth, there isn’t much of a hurry to raise rates at all.

In my opinion, the Fed is raising rates to have ammo to cut them in the next recession and because the stock market is allowing them to raise rates.