Will they or won’t they? That’s the guessing game many investors play heading into Federal Reserve meetings.

It’s easy to see why. When the Fed moves (or doesn’t move), it can have substantial impacts on stocks, bonds, currencies, and other assets.

So how can individual investors keep up–and get a sense of what’s coming down the pike? It’s a lot easier than it used to be, and it’s all thanks to something called the “CME FedWatch Tool.”

But first, some background. If you aren’t familiar with it, the CME was formed by the merger of the Chicago Mercantile Exchange and Chicago Board of Trade several years ago.

Like the New York Stock Exchange, it’s a marketplace where institutional and individual investors place trades. But unlike the NYSE, investors don’t trade shares of stock there. Instead, they use futures, options, and other derivatives to speculate on the direction and level of interest rates.

More specifically, they use Fed Fund futures to express their view on whether and when the Fed will change rates, and by how much. Trading in these contracts is extremely active. Some 3.8 million contracts changed hands in April alone, up 77% from a year earlier. By tracking pricing and trading data, you can determine on any given day whether or not investors think the Fed will move at various upcoming meetings.

But what if you’ve never traded futures, or don’t like complicated math and statistics? That’s where the tool I mentioned earlier comes in. It basically does the work for you, and spits out the results online here.

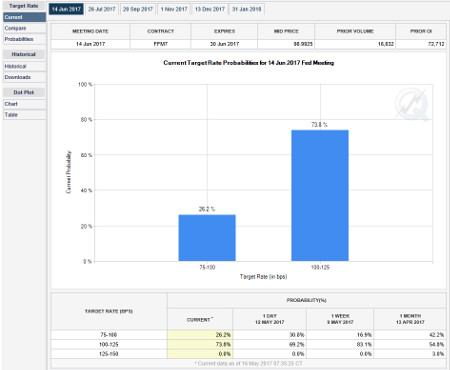

This is what the graphic looked like on Tuesday, May 16:

You can see that as of today (May 16), investors believed there was a 73.8% chance the Fed will raise rates by another 25 basis points (to a range of 1% to 1.25%) at the next meeting scheduled for June 13-14. If you look at the bottom right-hand corner of the graphic, you can also see that the chance of a move has risen in the last few weeks. Investors were only assigning a 54.8% probability of such a move as of mid-April.

Of course, these figures aren’t static. They change all the time based on economic reports, Fed policy speeches, and moves in other capital markets. If a monthly employment report shows that job creation just tanked, the probability of a hike will go down. If Yellen comes out and says she’s itching to hike rates again, the probability will go up.

But since the Fed took a pass on hiking at the May 2-3 meeting...and the economic data continues to come in solid...it sure looks like the fourth hike of this Fed cycle is right around the corner. Barring any more “Trump surprises” out of Washington or an explosion in market volatility, that would argue for additional moves in your bond and stock portfolios.

Specifically, consider shifting your fixed-income money out of investments like the iShares 20+ Year Treasury Bond ETF (TLT) and into funds like the SPDR Bloomberg Barclays Convertible Securities ETF (CWB) or SPDR Bloomberg Barclays Short Term High Yield Bond ETF (SJNK). Riskier bonds and shorter-term securities should outperform traditional, long-term Treasuries at this stage in the rate-hiking cycle.

When it comes to investing in higher-yield stocks, I also recommend you de-emphasize defensive sectors like utilities and Real Estate Investment Trusts (REITs). Favor “growthier” dividend-payers like Business Development Companies and Master Limited Partnerships instead.

Don’t forget to round things out with investments in economically sensitive sectors like financials, transports, and technology, either. They should continue to perform well regardless of how the Fed guessing game goes, thanks to strong earnings growth and the economic expansion that’s prompting the Fed to move in the first place.

Follow Mike Larson and subscribe to Weiss Ratings products here...