The best bet in this stable economic and interest rate climate is high yield municipal bond funds, most of which yield more than 3%, asserts Marvin Appel, MD, PhD. He’s president of Signalert Asset Management LLC.

State of the Market: The S&P 500 has finally eked out a new closing high this week (ending May 26), more than two months after its last leg up culminated in a rally on March 1. Our models remain overall neutral-bullish.

There are potential warning signs. But for now, the intermediate-term climate remains favorable and I expect additional modest gains to accrue, albeit with more volatility than we have seen so far this year.

US dollar sell-off should be near its conclusion

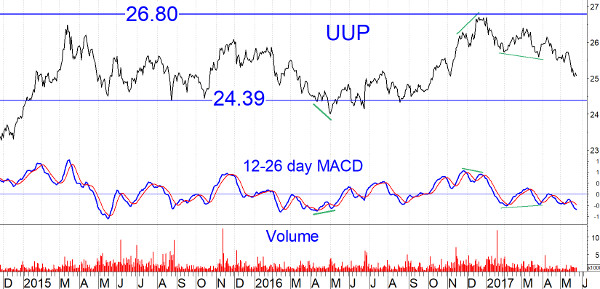

The US dollar has been very weak this year, with the PowerShares BD US Dollar Bullish ETF (UUP) down more than 5%. That means that the dollar has given back all that it gained after President Trump won the election. This is yet one more in the long string of investment shifts that occurred in the aftermath of the election, only to revert subsequently.

Since 2015, UUP has mostly stayed in the range of 24.39-26.80. UUP seems to be headed towards the low end of the range. Its MACD is at its most oversold level since early 2016. The implication is that UUP is near its downside objective and should find its footing within 2-3% of today’s close of 25.08.

The dollar’s decline has been the euro’s and the pound’s gain, which has provided tailwind to European equities. The iShares Europe 350 Index ETF (IEV) is at a nearly two-year high. Although its MACD is overbought, it remains flat.

This means that momentum remains strong. In contrast, the iShares MSCI EAFE Index ETF (EFA) has formed a negative divergence with its MACD. However, assuming that the euro and pound stop rising against the dollar, the currency tailwind will disappear and European equities will moderate their advance.

I recommend IEV as a long term holding, but only if you can buy the shares at 43.50 or less (the nearest potential support area). This will require a retracement of more than 4% from current levels, which we may not see for months.

Municipal bonds are an area of opportunity

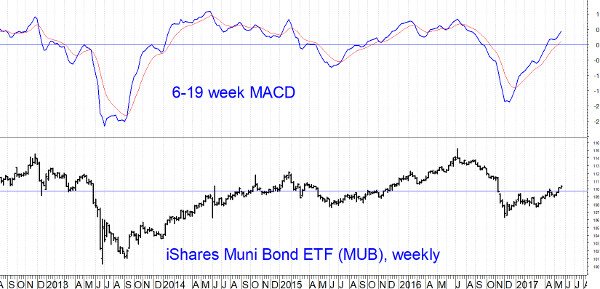

A number of municipal bond mutual funds trade reasonably well on our investment-grade corporate bond timing model, which has been on buy signal since April 25. For example, the iShares National Muni Bond ETF (MUB) is in a gradual uptrend. Its weekly MACD is above zero and rising, which is intermediate-term bullish.

The SEC yield is 1.8% and the duration is 6.25 years. (That means that a 1% rise in interest rates should result in a share price drop of 6.25%, and vice versa.) The Vanguard Intermediate Term Tax-Exempt Fund (VWITX) is a better bet with an SEC yield of 2.1% and a duration of 5.2 years.

The best bet in this stable economic and interest rate climate is high yield municipal bond funds, most of which yield more than 3%. As long as the economy remains steady, high yield and investment-grade municipal bond funds should behave similarly. It is only when there is a recession scare or when liquidity dries up that high yield muni bond funds are likely to turn risky.

One fund I recommend is Nuveen High Yield Muni (NHMAX). We will soon add it to the High Income newsletter portfolio. If you do buy NHMAX for your own portfolio, follow the hotline to watch for the sell signal on this fund.

Subscribe to investment newsletter Systems and Forecasts here…