Can you survive trading in today’s algo world? I believe you can, asserts John Person, a 36-year trading veteran who has written several books and featured speaker.

This is the first in a series of articles about “quantitative” and algorithm “algo” trading. The articles are designed to help you understand what algo trading is and to give out some simple programs along with informal trading systems that you can use.

Lately, there has been lots of media coverage on this subject, for good reasons. In fact, I recently heard there is a very large brokerage firm that eliminated its “technical analysis department” for a new “quantitative analytics division.” It is also a fact that robots are making investment decisions and trades with your money.

Quant and algo trading is based on mathematical formulas and not necessarily based on fundamental analysis. However, if an analyst can derive a rate of measurement such as how many “hits” in social media there are on a company, this could be an algorithm considered in a trade-generated decision.

System trading has been around for well over 25 years. The question: can you survive trading in todays’ algo world? I believe you can.

A discretionary trader can beat the odds, but remember it might be better to fight fire with fire or at least have signals with defined entry stop loss and a minimum profit target planned.

Let us define what algo system trading is. Simply put, it’s just computer codes that ask the trading platform to generate a trade. It’s based on defined sets of rules that can use price action (open, high, low, close) and how those four points of interest interact with past price action over a period of time; in other words, a rate of measurement. Added filters could be time of day, volume levels or quantity of Bids and Asks. Furthermore, it can also include percent changes on an intraday basis across correlated markets.

The major considerations for trades are that they occur in liquid markets, and based on time-tested rules; the system pretty much eliminates destructive human emotions. Two popular negative thoughts that keep traders from entering a long trade is the market may have moved sharply higher and either the trader feels the “market can’t go up any higher” or that “the risk is too great” for their trading account.

Take for example my High/Low Close Doji signal, first published in my book Candlestick and Pivot Point Trading Triggers in 2005, by John Wiley and Sons. It is a dynamic set-up that gives an entry, the conditions of stop loss placement, the time to hold onto a trade, and we can use a measuring technique to give a minimum profit target. In fact, that book gave out a trading system with a back tested performance in Chapter 11.

Examine the chart below which is a 60-minute chart on the United States Oil ETF (USO) with an algo system using the HCD and LCD set-ups. You can see the buy and sell signals including the entry and predetermined profit targets. This is completely automated which takes out the human emotion of not wanting to “buy high” and sell higher or what most traders find aggravating is knowing when to get out of the trade.

The chart above shows how one can automate trading ideas, which are based on a set of criteria’s that were based on those set-ups in that publication. However, since that book came out, there have been many changes in what and how we trade. For example, exchange traded funds (ETFs) and volatility products and options are hugely popular and open outcry pit trading is almost obsolete. We trade almost entirely off a computer. This makes computer programmers in high demand right now on Wall Street.

There are many algorithm or criteria which can be programmed. We as traders need to ask ourselves what makes sense and what has a strong frequency and reliability of working if one trades with oscillators and other indicators, such as using George Lane’s Stochastics Oscillator.

For a buy signal, one might ask to send an order to go long a stock when the Stochastics crosses above 28% after a low reading under 15% has been registered.

Other strategies might be to set up more buy signals would include:

Go long when an 8-period Simple Moving average closes above the 20-period Simple Moving Average and the range of a bar (time period) closes greater than both moving averages (C+H+L > both MAs).

The previous trade strategy would send an automated order to buy a preset number of shares of stock or futures positions like Emini S&P contracts or Euro FX contracts. Along with the order to enter a long position, the system would also send stop loss orders at a predetermined level and simultaneously, place a sell order above the market at either a predetermined profit target would be or a trailing stop loss order feature would be programmed with a subsequent profit target level.

With rigorous back test studies to find out what percentage of trades win versus lose, combined with the amount of time required to hold the trade until maximum gains on average are attained, the system could also be programmed to send an order to liquidate the trade and cancel any subsequent orders once the maximum holding time period has elapsed.

Other considerations for an algorithm trader would be spread, pairs or correlations. These “beta” or a percentage figure that compares an average daily move of one market to another over time can be employed. For example: with an inverse relationship between two markets like a decline in the Chicago Board of Options Volatility Index (VIX) versus a rise in SPDR S&P 500 Trust ETF (SPY) or a tandem relationship like can typically exist when gold rallies then usually we see gold miner stocks follow suit. Perhaps when one market generates a buy signal then one can anticipate another like or correlated (tandem or inverse) market will follow suit or trade in opposite direction. An algo can be added to pick up such a signal and allow a trader to participate in that trade opportunity that may normally be missed by trading manually off the computer screen.

In developing a trading system, it is critical that you trade in liquid markets and that the signals you are basing your trades criteria on are true.

To help us in this process one technique we used for years in our live trading room is that instead of placing a market order when a signal does fire off, we look to enter the trade on a stop entry a few ticks or points past where the signal was generated. This to ensure the signal is true and the momentum is in the market to carry prices higher in case of a buy signal. This helps confirm the signal is valid.

Traders always need to understand that not every trade will be a winner. No system is 100% perfect. There will be periods of drawdowns and one needs to be able to ride the rough times financially.

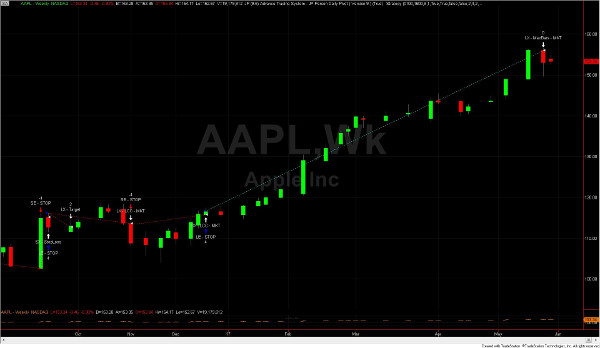

Examine this weekly chart on Apple (AAPL). Note: in a period of choppy consolidation in late October 2016 until December, there were two trades that generated small losses. However, the breakout momentum fired off long positions at 116.74 and based on the profit target criteria to offset the trade last week. A discretionary trader may not have gone long at that precise time or perhaps may not haver exited that trade at that precise time as well. Therefore, system trading can be instrumental in helping traders stay true to their game plans as well as their methodology.

Next: how to handle large orders.

Subscribe to John Person’s newsletter and education services here...