Start leaning against the tech crowd, asserts Mike Larson of Weiss Ratings. Or, start cashing in a few of those thousand-dollar Amazon.com (AMZN) shares, and grab a handful of Exxon Mobil (XOM) or Chevron (CVX) from the bargain bin instead!

Tech stocks are flying, while energy stocks are dying.

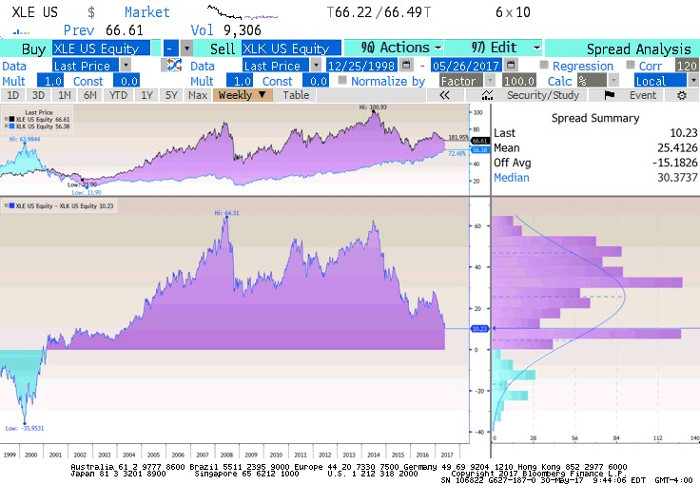

That’s been one of the biggest market stories so far in 2017. Just look at this ratio chart I created on my Bloomberg terminal. It shows the spread between the performance of the Technology Select Sector SPDR Fund (XLK) and the Energy Select Sector SPDR Fund (XLE).

What you want to focus on is the bottom-left panel. The higher the line, the more energy stocks are outperforming tech stocks. The lower the line, the more tech is outperforming energy.

You can see that my ratio indicator just fell to 10.2. While that’s not as bad as the negative-35 reading we saw during the dot-com mania, it’s far below average. It’s also just a fraction of the 64 level we hit when oil prices skyrocketed to almost $150 a barrel back in 2008--and the lowest since 2004.

Here’s another way to look at this trend: If you bought the XLK at the beginning of the year, you’ve already racked up a 17% gain. If you bought the XLE, you’ve already lost 11%.

That’s a truly shocking divergence, especially when you consider that crude oil prices have basically been moving sideways since last May. Natural gas, for its part, is roughly unchanged so far in 2017.

Here’s something else that’s odd: High-yield bonds are NOT collapsing right alongside energy shares. That’s different from the first phase of the energy sector meltdown from 2014-2016. Back then, high-yield bond prices tumbled in tandem with energy stocks amid fears of widespread debt defaults and bankruptcies in the oil patch.

Heck, the SPDR Barclays High Yield Bond ETF (JNK) is actually UP more than 4% year-to-date. By comparison, it shed 25% of its value from peak-to-trough during the energy stock meltdown a couple years ago.

I can’t say for sure when the trend will end. Nor can I say what might change the energy sector’s fortunes. OPEC just tried to support oil prices by extending production cuts into 2018. But the move had little positive impact.

What I do know is that this ratio is getting aawwwfffulllyyyy stretched. It also seems like everyone and his sister is already on board the tech stock train. So you may want to start leaning against the crowd. Or in practical terms, start cashing in a few of those thousand-dollar Amazon.com (AMZN) shares, and grab a handful of Exxon Mobil (XOM) or Chevron (CVX) from the bargain bin instead!

Follow Mike Larson and subscribe to Weiss Ratings products here...