Because we prefer a hedged strategy, we are going with the August contract soybean futures for access to better option premium and hopefully lower volatility in the futures contract, asserts Carley Garner, Senior Strategist for DeCarley Trading.

Soybean futures are trading at the biggest discount we've seen since early 2016. This alone doesn't make them attractive but there are a few things raising our eyebrows and enticing us to establishing a bullish position. For starters, MRCI (Moore Research Inc.) offers seasonal stats supporting the potential of a June rally.

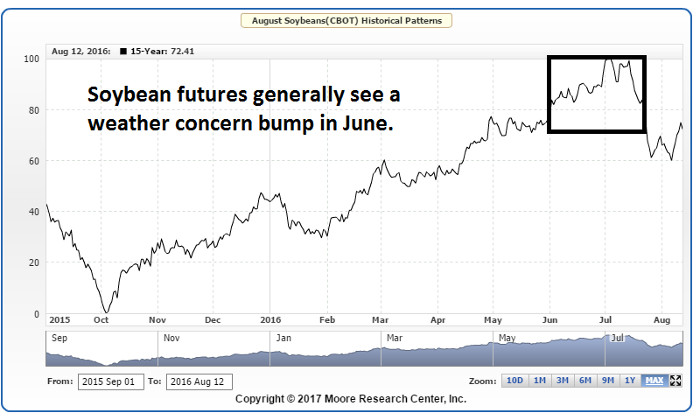

The chart below depicts the 15-year seasonal tendency of the August futures contract which tends to drift higher through June and the first part of July. The seasonal strength is most likely the result of speculators building a weather risk premium into pricing. After all, in most years there is at least a temporary concern than the growing environment is either too hot, too dry, or too wet. The seasonal service also offers stats on a July soybean futures trade; specifically, going long the July bean contract on or around May 28 and selling it on June 11 has produced a profit in 13 of the previous 15 years with an average gain of just under 30 cents ($1,500).

Because we prefer a hedged strategy, we are going with the August contract for access to better option premium and hopefully lower volatility in the futures contract. (In grains, the front month contracts tend to be more volatile than distant months.) Nevertheless, it is clear to see there is an upward bias in the complex. Naturally, seasonal tendencies aren't foolproof and past performance isn't always indicative of future results.

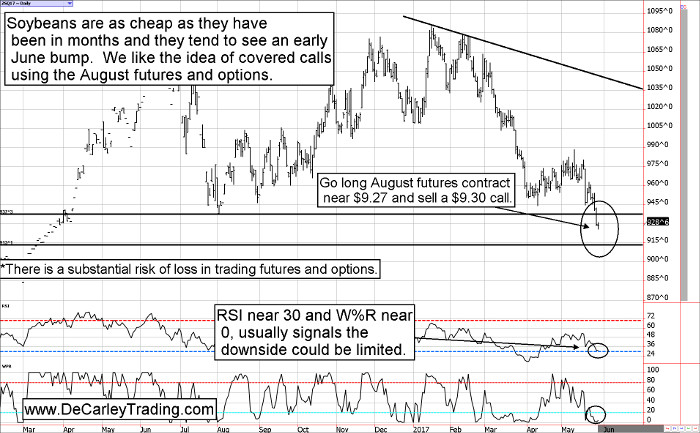

Although we believe there is potential for a rally in the short-term, we respect the market's ability to test the $9.00 area in the August futures contract. For this reason, we believe that any bullish strategy implemented should be one with a healthy hedge. We like the idea of going long the August soybean futures contract near $9.27 and then selling the August $9.30 call option for about 23 cents, or $1,150. This provides the trade with a risk buffer of 23 cents, meaning at expiration the trade pays something as long as the price of August soybeans are above $9.04.

The maximum profit of roughly $1,300 before considering commissions and fees occurs if the price of the August futures is above $9.30.

At this price, the trader keeps all of the premium collected plus the difference between the futures entry price and the strike price of the option. The risk is theoretically unlimited beneath the breakeven point of $9.04. If prices fall below this level the trade is similar to being long a naked futures contract (at which time we would probably be shopping around for trade adjustments).

The bottom line is soybeans are cheap, but commodities can always get cheaper. Thus, those looking to play the market as a bull should leave plenty of room for error.

Subscribe to e-newsletters by Carley Garner at www.DeCarleyTrading.com.