New short trade ideas can be initiated if GLD continues to trade above $119.20. Depending on how much room you want to give this trade to move around, use a risk price between $123.03 and $125.00, suggests Landon Whaley, Founder and CEO of Whaley Capital Group.

The SPDR Gold Trust ETF (GLD) gained 90 basis points in the week ending June 2. Everyone and their mother believes the May non-farm payroll report, which was released this morning, was a complete dud. The problem with that opinion is that it’s based on the wrong information.

The most important aspect of any economic data series is the annual change of a given data point. In May, non-farm payrolls increased at a 1.77% annual growth rate versus a 1.66% annual growth rate in April. This, my friends, is an acceleration in job growth and is very bearish for gold. It took Goldman Sachs all of ten minutes to adjust their expectations for the next Fed rate hike based on the May labor reports. They too, are wrong. The Fed will still hike interest rates later this month.

Truth be told, it makes my job easier when everyone focuses on the wrong things. Remaining SHORT of GLD until US growth begins to slow or the Fed changes the trajectory of its policy.

Fundamental Gravity: Bearish as long as US growth is accelerating and the Fed remains on a path towards normalization.

Quantitative Gravity: Bearish because despite a 5% rally in the last three weeks, GLD has barely regained half of its massive decline from the last six months of 2016. What’s more, gold volatility, measured by the GVX index, has increased 6% during this most recent rally. When a financial market’s volatility increases it is a bearish signal, each and every time.

Behavioral Gravity: Bearish because money managers increased their long exposure last week by the most in almost nine years. Net positioning in gold futures is leaning long despite the Fundamental Gravity being decidedly bearish. This tells me the behavioral related risks of a short trade are low.

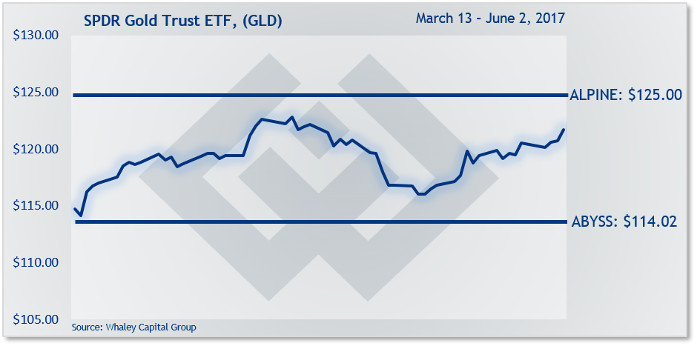

Trade Idea: New short trade ideas can be initiated if GLD continues to trade above $119.20. Depending on how much room you want to give this trade to move around, use a risk price between $123.03 and $125.00. Your initial profit target price range, for some or all of your position, is between $116.38 and $114.02.