The strong labor market and strong earnings data are nirvana for the market. It’s not surprising to see the rally continuing even with the Fed hiking rates. The hike in June shouldn’t do anything to stop the party, asserts Don Kaufman, Co-founder of TheoTrade.

In the Beige Book, the Fed reiterated its viewpoint on the economy and monetary policy. There is no doubt the Fed will raise interest rates in the middle of June. The market is reflecting this as there is now a 92.3% chance of a rate hike. The Fed said the economy is growing moderately which is an accurate assessment.

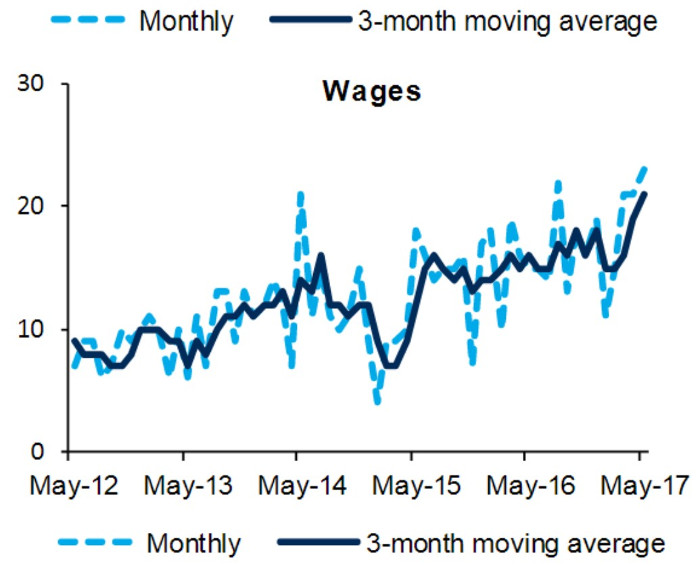

The Fed mentioned that a manufacturing firm is raising wages by 10% for unskilled workers. There seems to be more tightness in the manufacturing labor market than other sectors. However, I find the mentioning of this one firm grasping at straws because there will always be firms raising and cutting wages, but the only thing that matters is median and average weekly earnings growth. The Fed wants to justify its rate hikes with weekly wage growth, but it hasn’t happened yet. I think wage growth should come if the labor market continues to add a great deal of jobs. However, it’s important to acknowledge the reality that it hasn’t happened yet.

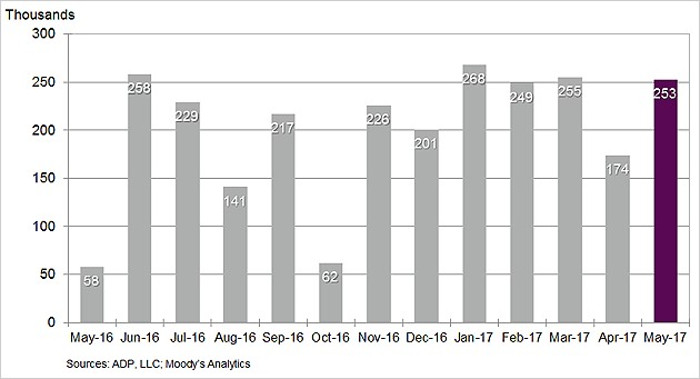

Speaking of jobs growth, the ADP Private Sector Report for May showed there was 253,000 jobs created. As you can see from the chart below, this was 15,000 jobs shy of the best report in the past 12 months. This beat the median estimate by economists which was for 180,000 jobs. The economy continues to add more jobs than the Fed expects the economy to add in the long run. This is while the economy might also be growing faster than what the Fed expects long-run GDP growth to be in Q2 as a bounce back quarter is looking more likely. The Fed has made faulty predictions on the amount of slack in the labor market for the past few quarters.

Small businesses had another healthy month of job growth which is consistent with the small business optimism surveys. Small businesses added 83,000 jobs, mid-sized businesses added 113,000 jobs, and large businesses added 57,000 jobs. I find it perplexing that while small firms are seeing contracting margins and large businesses are seeing expanding margins, small businesses are hiring more workers. I understand that hiring more workers can cause declining margins if the workers aren’t productive, but you would think a sustained decline would cause small businesses to pull back on hiring.

And 48,000 goods-producing jobs were created, led by 37,000 construction jobs. The report said 205,000 service-producing jobs were created, once again led by the professional and business category. This is a good sign because these jobs are typically well paying. This report is a good sign for the BLS report which will be released on Friday.

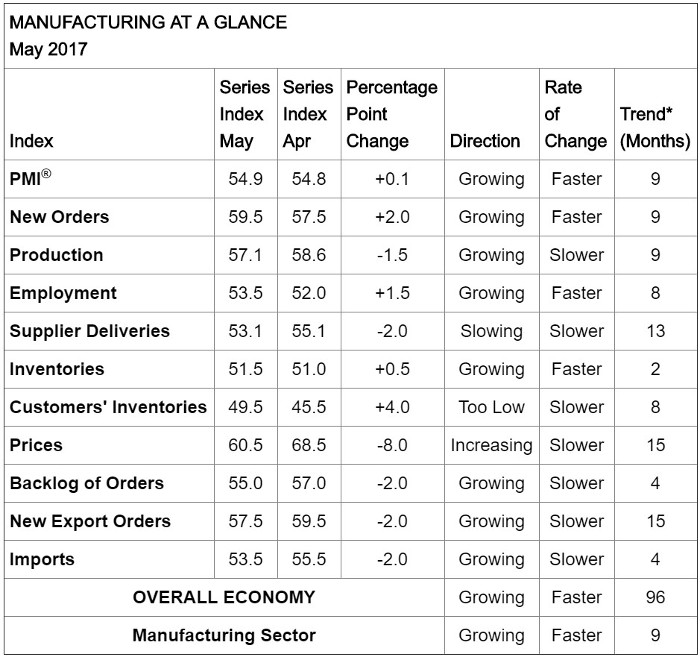

On Thursday (June 1), the Manufacturing ISM Report came in with the PMI at 54.9. This report is consistent with 3.7% GDP growth. In the first quarter, the ISM reports were laughable because they showed even better numbers even as GDP growth came in at 1.2%. Now the two have converged as GDP looks to rebound and the ISM report comes down slightly. The chart below breaks down the subcategories of the report. As you can see, the overall economy and the manufacturing sector are accelerating, but most of the subsectors are showing slowing growth.

The quotes taken from business leaders in this report were very good. A fabricated metal products firm said, “Business is booming, and getting direct employees is increasingly difficult.” While the GDP and ISM reports are now acting more in concert, this quote still goes against the slow wage growth. We’ll get more details on wage growth in the BLS report on Friday.

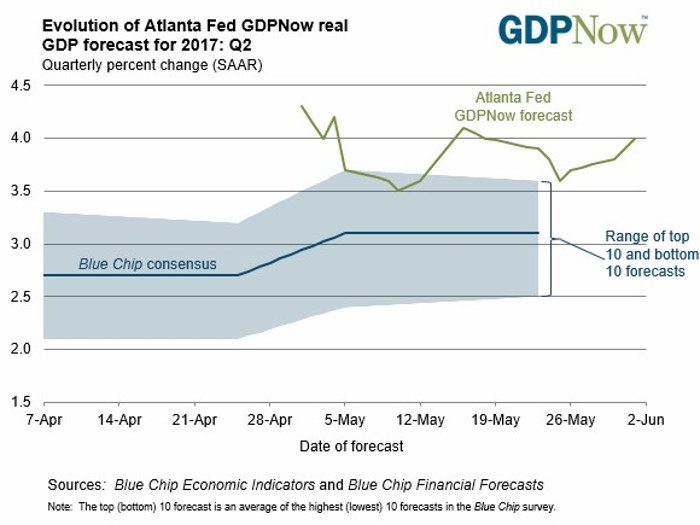

As I mentioned, the ISM reports earlier this year were even higher, meaning they expected well above 4% GDP growth. This time the 3.7% annualized GDP growth expected isn’t far from reality. It’s still early in the quarter, but the blue chip expects 3.1% growth and the Atlanta Fed expects 4.0% growth. The Atlanta Fed’s prediction for growth went up because of a few reasons.

The ISM report caused the estimates for real consumer spending growth and real nonresidential equipment investment growth to increase from 3.3% and 5.1% to 3.6% and 6.6% respectively.

On the other hand, the forecasts for Q2 real nonresidential infrastructure investment growth and real government spending growth fell from 6.2% and -0.3% to 3.4% and -0.7% respectively because of the poor construction spending report. As you can see from the chart below, the month-over-month US construction spending growth was -1.4% in April which is the third worst construction spending growth in 6 years. It was lower than any of the 41 estimates by economists.

The report isn’t a signal of a negative trend, but it’s interesting to see the manufacturers speaking so positively about the economy in the April ISM Manufacturing Report and have such a negative construction spending report. Either the report needs to be adjusted or the management teams saw this weakness as temporary.

In April, private sector construction jobs fell 2,000 which coincides with this weakness. I said earlier, the construction industry created 37,000 jobs in May. This may mean May’s construction spending report will be better than April.

Adding confusion to the ISM Manufacturing Report, last week the Richmond Fed’s manufacturing index was 1 which missed expectations for 15. New orders were 0 which was down from 26. Shipments were -2 which was down from 25 and the order backlog was -15 which was down from 4. On the bright side of that report, the wages index was 23 which was up from 21 last month as you can see from the chart below. The employment index was up from 5 to 6.

If even in a bad report, the manufacturing labor market is strong, it must be doing well

Conclusion

The strong labor market and strong earnings data are nirvana for the stock market. It’s not surprising to see the rally continuing even with the Fed hiking rates. Rates are still low, so the rate hike in June shouldn’t do anything to stop the party.