Traders and investors believe that in the capital markets there is no place or should be no place for magical thinking. I have observed otherwise, asserts trading legend Jake Bernstein in the second of three weekly parts.

Although many traders wallow in superstition, there are powerful tools which we can use to counteract the serious drawbacks on performance that are the result of subjective decisions. Given the availability of massive historical databases and inexpensive but powerful computer technology, any superstition or market myth which can be expressed in rules can and should be back tested. Only in so doing can we determine the validity of indicators and concepts which are popular but which may not be effective.

Although back testing is a multifaceted endeavor which requires strict adherence to its own set of rules, and back testing can be used to “create” seemingly good performance, proper back testing procedures can yield a wealth of reliable information. It’s useful for traders who are seriously interested in objective, rule-based strategies. Those who are still willing to remain trapped in the quagmire of subjective indicators will eventually see the light but the process of such insight will be costly emotionally as well as financially.

A case in point

In the last installment of this series I cited the popular dictum “sell in May and go away”. I raised some serious questions about what this oft-cited myth really means. Unfortunately, this aberrant belief raises more questions than it answers. Let’s look at some historical facts.

The data

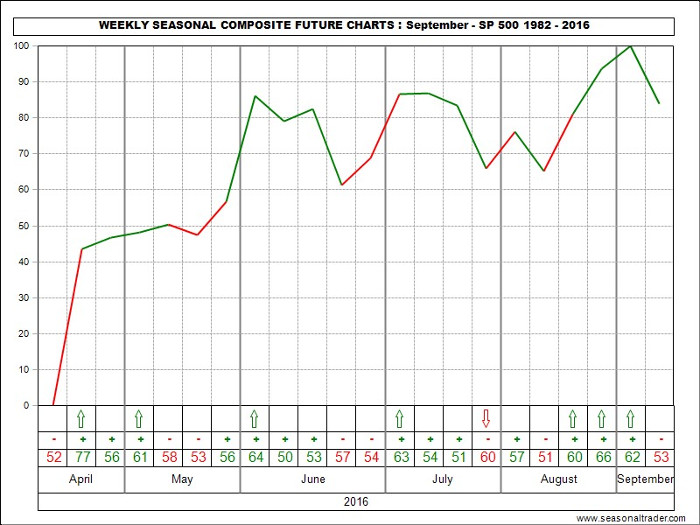

Assuming that “sell in May” means go short on the first day of May, I examined a seasonal chart showing the behavior of S&P futures back to the start of trading during the month of May and beyond. At www.seasonaltrader.com the composite seasonal chart of S&P futures, which appears below shows the average behavior of S&P futures during the indicated months.

The numbers below show the percentage of time September futures have moved up or down for the week. As you can see, the month of May has had a tendency to end higher than where it started. Therefore, the strategy of selling early in May has not been a winning proposition.

After May is over the tendency has been sideways which casts doubt on the profitability of this market myth. However, we can be even more precise. In the next installment of the series, we will look at the actual behavior of prices within specific dates. This will prove to be very revealing.

Subscribe to The Jake Bernstein Online Weekly Capital Markets Report and Analysis here…