The consumer looks weak based on the uptick in credit card default rates, a major headwind for GDP growth if it continues. Watch for volatility during earnings season in four weeks, asserts Don Kaufman, Co-founder of TheoTrade.

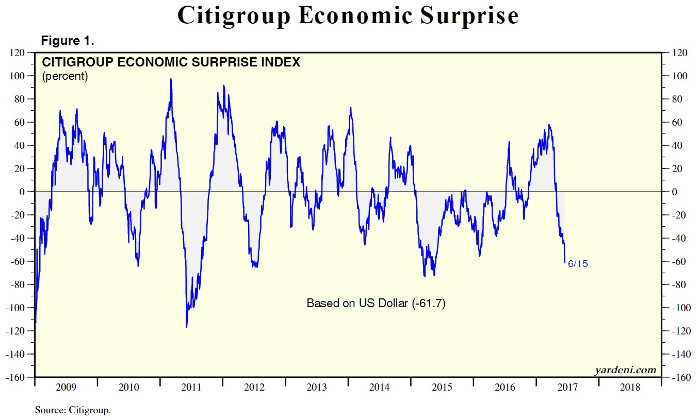

As I have mentioned, the Citi Economic Surprise Index doesn’t indicate how the economy is doing but may be a good indicator for predicting turns in the cycle. Most of the time, the surprise index is useless because it shows changes which aren’t predictive. It’s similar to a rate of change chart of GDP.

GDP growth has slowed a few times this recovery, but that didn’t mean a recession was coming. GDP is going to accelerate in Q2 from Q1, but that doesn’t mean the economy is in great shape. However, when the rate of change moves sharply in one direction, it’s worth paying attention to.

As you can see from the chart below, the macro surprise index has now fallen to -61.7. This doesn’t mean the economy is headed for a recession, but it is worth monitoring. I predicted the index would fall a week ago when I mentioned that June is its worst month of the year. The question is whether it rebounds in July like the seasonality suggests. The index tends to reverse sharply, so I wouldn’t be surprised if it went positive in July. I would consider this latest move in the index to be a slight negative. I have downgraded its importance after doing more research into it as it has become the top chart bears share lately.

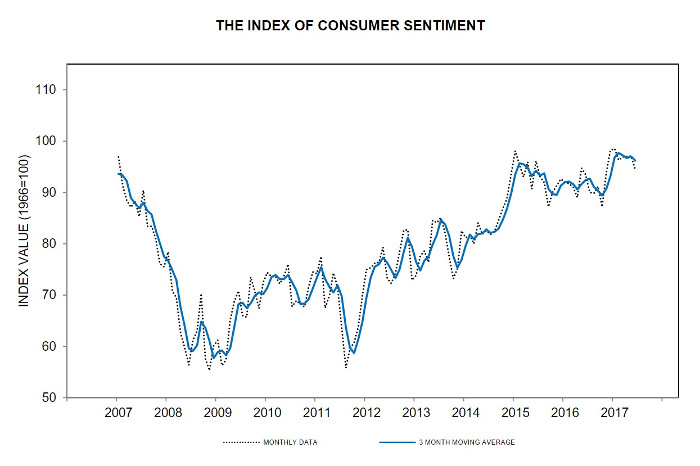

Finally, my prediction that consumer sentiment would fall has come true. As a reminder, the lack of fiscal stimulus and the very high sentiment index were the reasons I felt it would fall. The University of Michigan Consumer Sentiment Index, which is seen in the chart below, fell 2.7% month over month from 97.1 to 94.5. The current economic conditions index fell 1.9% month over month and the index of consumer expectations fell 3.4%. The decline is now acting in concert with the weak retail sales report I went over with subscribers. That’s negative for Q2 GDP growth which is looking less likely to have a 3 handle.

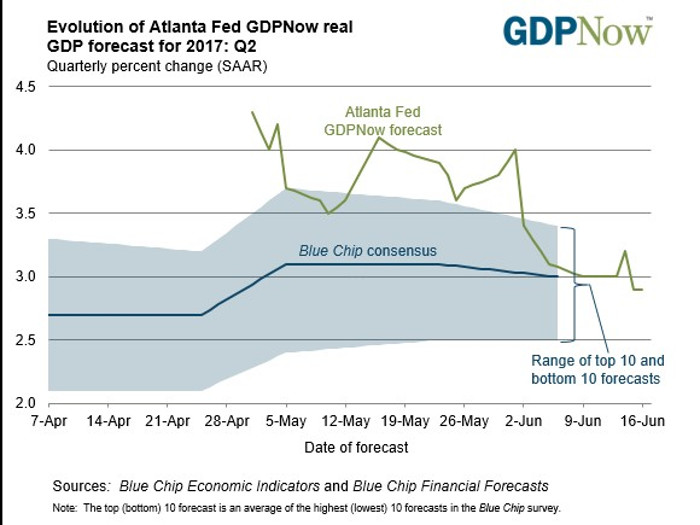

Speaking of Q2 GDP growth, the models put out by the Fed are now worth paying attention to. Because the Fed doesn’t alter them, I find them worth looking at more than what the investment banks put out. Because the investment banks don’t publish their models, they can easily alter the results to get whatever they’re looking for. They have a bias to be positive to drum up business. Models aren’t perfectly accurate, so sometimes they will be more negative than the actual results. Investment banks wouldn’t want to unnecessarily suppress activity. The go-to strategy for public firms is to always be optimistic about the economy and then blame the weak economy if business falters.

As you can see from the chart below, the Atlanta Fed’s model has fallen from projecting 3.2% growth to projecting only 2.9% growth. The blue chip is forecasting 3.0% growth. The trend always seems to be down with the Atlanta Fed model. That’s especially worrisome because it gets more accurate as time moves on. The first estimate is a meaningless guess based on sparse survey data. Now, most of the data for April and May has been reported, so it’s a good guess. The latest estimate fell because of the weak housing starts data which pushed the estimate for residential investment growth from 1.8% to 0.4%. It also fell because the Import/Export Price Index caused the estimate of the contribution of net exports to Q2 GDP to fall from -0.23% to -0.34%.

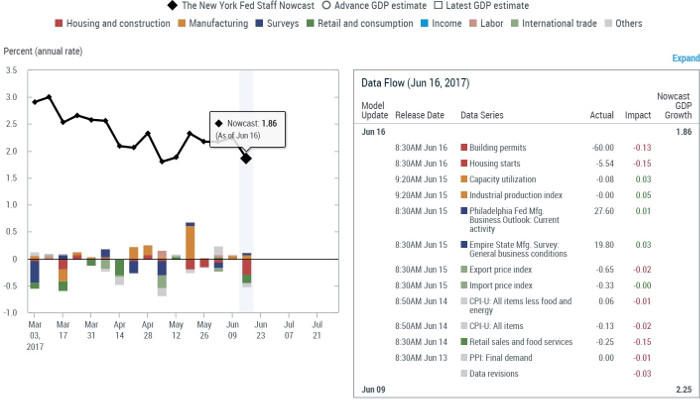

The latest New York Fed estimate for Q2 GDP growth also fell as you can see from the chart below. It went from 2.25% to 1.86%. It’s a role reversal from last quarter which had the NY model more optimistic. Q3 will likely be the same situation because the NY model is only predicting 1.54% growth as of today. That’s not indicative of what the Q3 report will be, but it will likely start out weaker than the Atlanta Fed model.

We’ll know for sure once the Atlanta Fed starts putting out estimates in early August. As you can see from the table, the building permits, housing starts, and the retail sales reports all had the biggest negative impacts on this Q2 estimate. This means the average guess between the Atlanta Fed and the NY Fed is for Q2 GDP growth to be 2.38%.

Judging from the reports I have researched on the economy, I think that’s a reasonable guess. This further shows how the macro surprise index isn’t a metric to look at on its own. The forecasters may have expected economic reports equivalent to 4% growth. If they had lower guesses, the macro surprise index would be higher, but the data would still be the same.

I think many economists and Fed officials are operating under the assumption that any weakness is transitory. Conversely, any strength is also transitory, but that point isn’t made as often. Those assumptions have worked well this recovery. It’s the idea that the data doesn’t matter because it will always reverse itself.

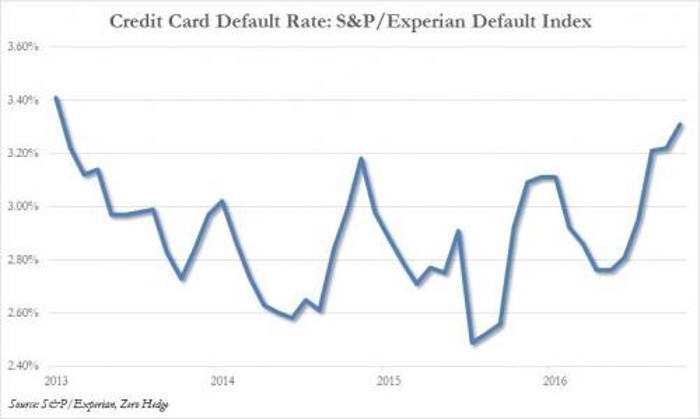

The easy way to beat the Fed and the economists at projections is to latch onto when the cycle is turning because the Fed will be late to acknowledge what is happening. As you can see from the chart below, the March credit card default rates are up 13% year over year to 3.31%. This is a bad sign for the consumer; it may signal the cycle is turning, but I’d like to see more evidence before making that call.

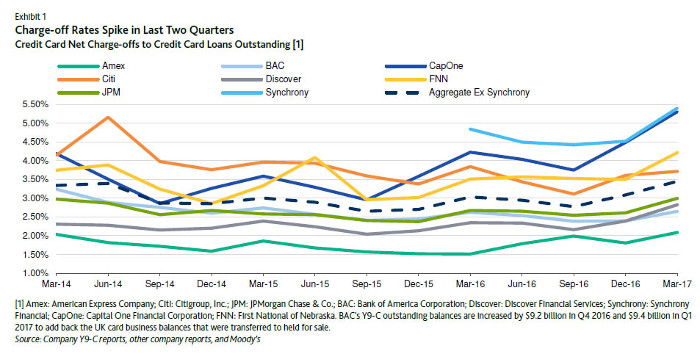

The chart below breaks down the increased charge-offs seen by the top credit card firms. The question remains if this mini-trend will continue.

If it does, GDP growth estimates may be too high because those who default on their loans must start saving money (defer spending) as they won’t be able to buy goods on credit anymore.

Conclusion

The consumer looks weak based on the uptick in credit card default rates. This would be a major headwind for GDP growth if it continues. It won’t matter for the stock market until a recession comes.

The stock market rallied with 1.2% GDP growth in Q1, so 2.38% growth certainly won’t stop it. The next catalyst I’m focused on for potential volatility in the market is earnings season which starts in 4 weeks.