With Trumphoria priced in, and recent economic data softening, we see too much expense in the Eurozone, Far East, and Australasia to remain holders, but favor trading short-term in the US, asserts Ziad Jasani, Toronto, in his weekly Trader video.

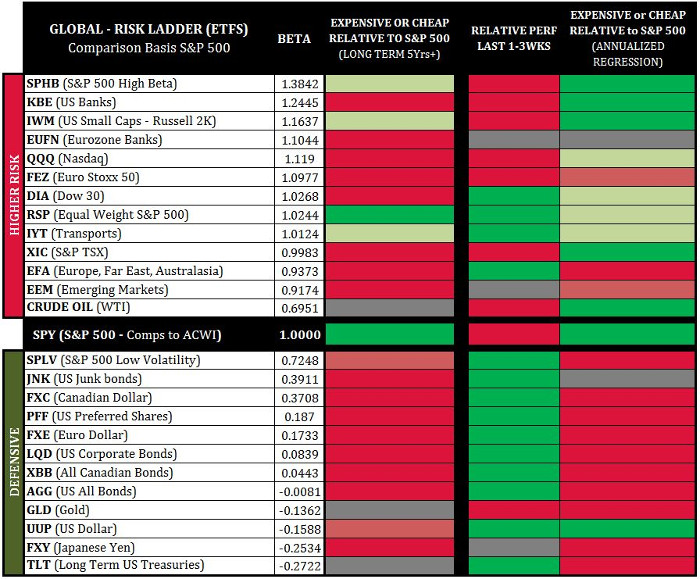

Here is my Global Risk Sentiment as of June 18:

Risk, in general, remains expensive from a longer-term perspective. (Bonds less expensive.)

Sentiment in the shorter-term is leaning Risk-On; defensive asset classes are largely dislocated and expensive on annual routines while most higher risk asset classes are on the cheaper side.

Most of the higher sensitivity and commodity-linked spaces are on the cheaper side of annual routines which allows for any bullish global macro catalyst to be received eagerly.

The iShare Core S&P/TSX Capped Composite Index ETF (XIC), iShares Transportation Average ETF (IYT), iShares Russell 2000 (IWM), and PowerShares S&P 500 Hi-Beta Portfolio (SPHB) issues present as dislocated and cheap on annual relative routines, arguably depicting Trumpflation is over, but simultaneously primed for a bounce on positive Trump headlines.

US Financials SPDR S&P Bank ETF (KBE) also find themselves on the cheap short-term and would require “good news” on Trump’s plans to re-direct money flows away from bonds.

Short-term sentiment is fully linked (and leveraged) to whether Trump’s fiscal spending plans and tax reform can happen.

Major index direct price regression

US Markets have moved back towards neutral on annual routines, while International Developed Markets iShares MSCI EAFE ETF (EFA) remain 1.5 Std Dev+ expensive (and EEM 0.5 Std Dev).

The Toronto Stock Exchange (TSX) remains dislocated and cheap. This is an atypical market configuration that lends itself to short-term bounces in North America, but under-performance from the rest of the world.

This configuration also suggests entrenchment of a loss-of-faith in Trump’s growth plans. A bullish confirmation on tax reform and infrastructure spending is required short-term to hold the market up at new highs, along with a decline in geopolitical risk, especially now as Q1 earnings are in the rearview mirror.

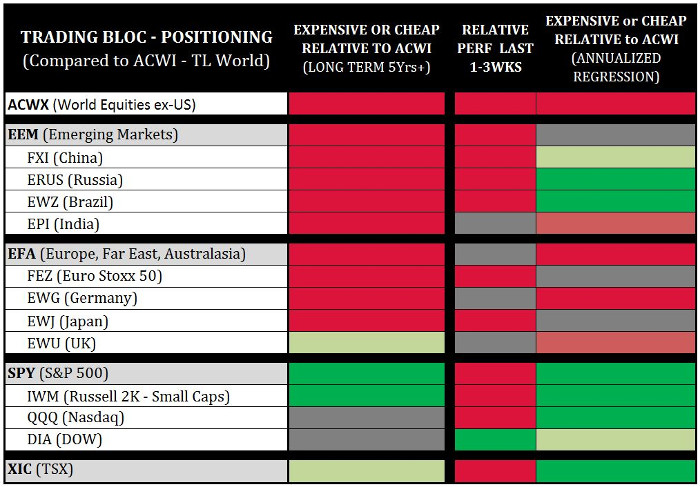

Trading bloc positioning

Last week Eurozone Markets neutral performed the world while the Dow out-performed the world into week’s end.

Emerging Markets have gotten complacent near highs and under-performed neutralizing on annual routines.

US markets are on the dislocated and cheap side of annual relative routines with the world, suggesting any bullish Trump news would see the US out-perform.

The TSX under-performed the S&P 500 over the last month and a half on Oil, Tariffs and Mortgage Markets.

With Trumphoria priced in, and recent economic data softening, we see too much expense in the Eurozone, Far East, and Australasia to remain holders, but would favor trading short-term in the US temporarily, while awaiting a pull-back or correction to put longer-term capital back to work.

Shorter-term risk held within the TSX is viable above 15,175-110, and above 2,446 on the S&P 500.

View the latest videos from Ziad Jasani of the Independent Investor Institute here