We like the idea of buying the December corn futures contract near $3.80 and then selling the at-the-money-call option (380 strike price) for about 22 cents, or $1,100, asserts Carley Garner, Senior Strategist for DeCarley Trading, and author of four books.

This time of year the grain markets react primarily to weather concerns. At this particular time, the market doesn’t seem to have any concerns regarding the upcoming supply of corn. The futures markets have erased all weather premium from pricing, but in our view, it is a little too early for the bulls to throw in the towel. While it is true seasonals suggest the price of corn often wallows this time of year, we feel as though depressed pricing might prevent further losses in the commodity.

There are a handful of bold forecasts calling for hot and dry weather once we get beyond the next week or two of favorable growing weather. In short, it feels like the “rain makes grain” sell-off has been overdone.

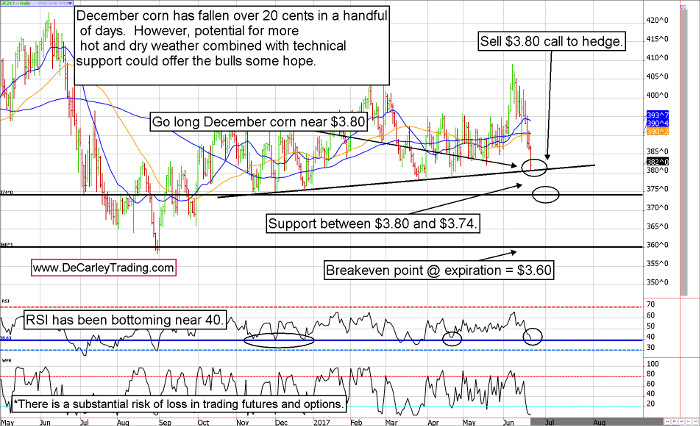

Further, the chart work we’ve done is supportive to the price of corn, or at the very least the selling should slow down. December corn has had a habit of forming a bottom when the RSI (Relative Strength Index) dips to 40, and we are currently seeing such a reading. Also, trendline support comes in near $3.80 and oscillators such as the Williams %R are in oversold territory. There are no guarantees that any of these factors will reverse the trend, but they increase the odds of a rally dramatically.

That said, we believe it makes sense to employ a strategy with plenty of room for error.

If the charts are wrong and seasonals are correct, the market could grind lower. We like the idea of buying the December corn futures contract near $3.80 and then selling the at-the-money-call option (380 strike price) for about 22 cents, or $1,100. This trade has a lot of time on it (156 days), which is concerning, but it also has great odds of success.

If held to expiration, the trade pays off something as long as the price of corn is above $3.60. If the market is below $3.60 at expiration, the risk is theoretically unlimited (because the futures contract is now naked). This contract hasn’t been below $3.60 since August of last year and even then it was only a temporary blip.

The maximum profit of $1,100 occurs at expiration if the price of corn is at or above $3.80. In other words, we only have to be right by a tick at expiration to keep the entire premium collected.

Despite coming with unlimited risk, the margin on this trade is a little less than $600 and the risk is 20 cents under the market. There are never any guarantees in trading, but this offers traders attractive odds without taking on excessive risk.

Subscribe to e-newsletters by Carley Garner at www.DeCarleyTrading.com.