New short trade ideas can be initiated if OIL rallies to $5.14, or higher. You can use a risk price between $5.33 and $5.80, depending on how much room you want to give this trade, suggests Landon Whaley, Founder and CEO of Whaley Capital Group.

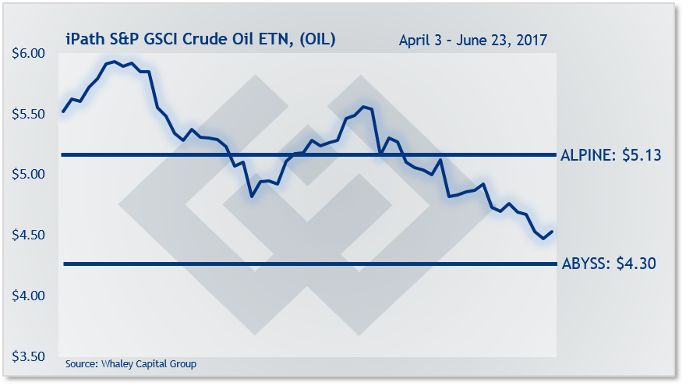

The iPath S&P GSCI Crude Oil ETN (OIL) declined approximately 5.0% in the week ending June 23 as the market remains concerned that OPEC production cuts aren’t going to be enough to balance the supply dynamics in crude.

Specifically, investors are concerned about the recent production ramp out of the US shale industry, Libya and Nigeria, all of which are weighing on sentiment. In fact, sentiment is so bearish right now, not even comments from the Iranian oil minister regarding further production cuts could flush out buyers for black gold. We are nearing a point where both price and sentiment will find a bottom before crude trades higher.

That said, I believe that point is still in the future. Staying with the SHORT bias and back with a new trade idea.

Fundamental Gravity: Bearish because global inventories remain well over-supplied and US production is at the highest level in three years.

Quantitative Gravity: Bearish as crude is in crash mode since peaking at an intermediate term high in mid-April. Not only is the cascade in price confirming a bearish bias but both volume and volatility are exploding higher on crude’s down move. The average daily volume in OIL has increased by 50% since the latest price plunge began. What’s more, oil volatility, measured by the CBOE Crude Oil ETF Volatility Index (OVX) is trading at $32 and creeping higher. When a financial market’s volatility increases it’s a bearish signal, each and every time.

Behavioral Gravity: Bearish because investors are leaning on the bullish side of this trade but not currently at extreme levels. In other words, being long crude oil is not yet a consensus trade but neither is being short. This tells me the behavioral related risks of a short trade are low.

Trade Idea: New short trade ideas can be initiated if OIL rallies to $5.14, or higher. I can’t say this strongly enough: do not chase this market lower, because markets don’t go straight up or straight down.

OIL has been in a downtrend since peaking in early January, and while I believe there is another 10% downside, it’s not a question of if this market will experience a countertrend rally, but simply when the rally will occur.

The worst thing you can do is initiate short trades while a stock is falling. If you do, when that fierce countertrend rally occurs—and these are often quick and violent—the damage to your portfolio will have you looking for the nearest door to float on.

Remember, we don’t tug on Superman’s cape, we don’t pull at the mask of that old Lone Ranger and we don’t chase markets.

Once you’ve initiated a new short trade in OIL, you can use a risk price between $5.33 and $5.80, depending on how much room you want to give this trade to move around. If the trade moves in your favor, you should book profits if OIL falls down to the $4.75 to $4.30 area.