Today’s trade idea: If the S&P 500 reverses and breaks support of 2,400 and the TSX breaks below (15,257), closing most short-term long-side trades makes sense, asserts Ziad Jasani, of the Independent Investor Institute, Toronto, in his weekly Trader video.

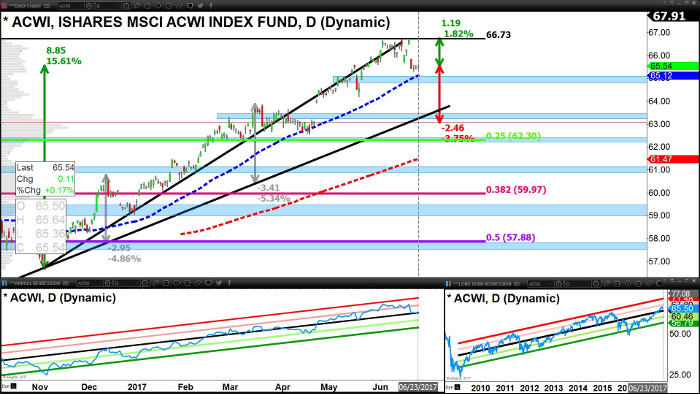

The global equity market has every reason to correct (-10% to -15%), especially with the US Fed tightening into slowing economic growth. However, reason and logic are “Trumped” by hope, the fear of missing out (FOMO) and expectations for bottom lines to delight in Q2 earnings season. The focal areas: Technology, Healthcare, Energy, and Materials.

Oil is staging another bounce. That will help keep the S&P/TSX Composite Index (TSX) above its 200-Day Average (15,257) this week, with resistance of 15,400-360 and even the 50-Day Average (15,460) in its sights.

We got long Energy/Oil (short-term) on June 23. Gold is likely trapped in a tight range 1,251 as the Market decides whether “Growth is good again” and pushes the USD higher or suffers weaker economic data and flees to the Yen, Gold, and Bonds (lower probability as these assets are stretched to expensive on annual routines).

We see North American markets as better relative-value this week vs. the Eurozone and expect the S&P 500 Index (SPX) to challenge all-time highs (2,453.8) with the potential to stretch to 2,471 (1 Std Error mark on latest 52 weeks). However, if the S&P 500 closes the week below 2,430 we are likely moving into a pull-back.

This week’s economic data is back-end loaded (Thursday/Friday), with a focus on growth and personal consumption.

We start the week with US Core Durable Goods data and end it with GDP data (US Final Q1, UK, CDN). The stronger the data the better chance North American markets make new highs. However, any strength in the Eurozone is likely short-lived until we hear next from Mario Draghi of the European Central Bank.

Our expectations for the week

• USD and Treasury yields rise into week’s end. PowerShares DB US Dollar Bullish ETF (UUP) target of $25.39.

• Oil bounces off $43 with $46.55 in its sights; energy equities move in tow.

• Gold toggles its 50-Day Average ($1,260), pops above but remains < $1,280.

• Eurozone Equities stage a dead-cat bounce, fail to make new highs.

• S&P 500 starts the week >2,435, attempts to limp out to new highs 2,447-63.

• TSX tests 15,400-360 (resistance), pokes out to 50-Day Average but closes under.

• Our Independent Investor Institute community voted on Scenario B (Indecision) to play out this week.

Strategy (Short-Term = Days-to-a-Week)

• Use price strength to trim mid-to-longer-term positions.

• Limit, reduce and/or trail with stops on defensive equity positions (Utilities, Staples, REITs, Telecom).

• Short-term risk-capital only to play break-out above 2,446 on S&P 500 and bounce above 200-Day Average on TSX (15,257) in the following cyclical spaces: Financials, Energy, Industrials.

• If the S&P 500 reverses and breaks support of 2,400 and the TSX breaks below (15,257), closing most short-term long-side trades makes sense.

View the latest videos from Ziad Jasani of the Independent Investor Institute here