Call options are an ideal way to play a bullish slant on XLK. Buying a call allows you to participate in continued gains, while lowering your overall dollars at risk, asserts Elizabeth Harrow, Director of Digital Content at Schaeffer’s Investment Research.

As you've surely noticed by now, the tech sector has been on fire lately. The Nasdaq Composite has rallied to new record highs, and big names like Alphabet (GOOGL) and Amazon (AMZN) have seen their respective share prices pass the millennium level. Against this backdrop, you might assume that the bull market in tech is looking a little toppy. However, historical data from our Schaeffer’s Quantitative Analysis Department suggests that summer gains are just starting to heat up.

Over the past 10 years, the Technology Select Sector SPDR Fund (XLK) has emerged as the top-performing ETF during the month of July. XLK has netted a positive return 80% of the time, with an average July return of 3.07%. And from a broader perspective, the third quarter is a great time to be invested in XLK. The tech fund's average return is 3.3% during the July-September stretch, with 70% of those returns positive.

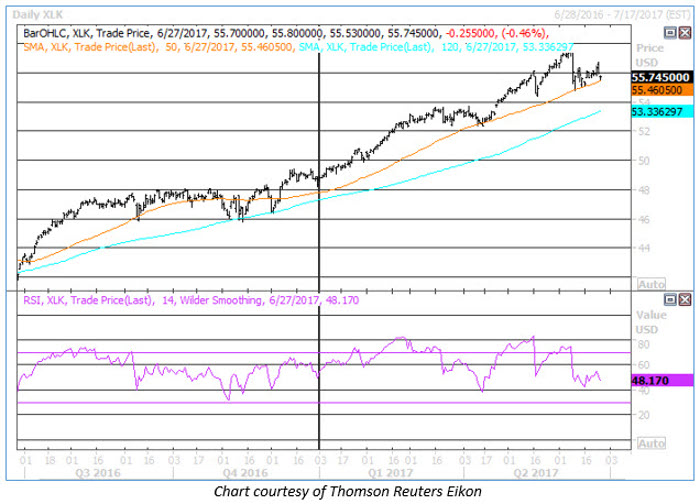

And as we get closer and closer to the first trading day of July next Monday, XLK is in a very compelling position on the charts. A recent pullback from the June 9 peak of $57.62 has allowed the shares to work off an overbought condition, and the fund is now perched right on its 50-day moving average. Along with its 120-day counterpart, this benchmark trendline has provided key support for XLK over the past year. Another bounce from the 50-day could set the wheels in motion for a standout July for this tech fund, which counts Apple (AAPL), Microsoft (MSFT), Facebook (FB), and GOOGL among its top holdings.

With this strong seasonal performance and solid chart support in mind, it’s compelling to see short interest on XLK hovering near multi-year highs. Short interest increased by 16.5% during the reporting period ended June 15, and now totals 33.92 million shares--just shy of the early December peak at 35.95 million. A bounce by XLK could catch these shorts off-guard, and a rush to cover by some of the weaker bearish hands could help the shares continue their uptrend.

Given the headline risks in this market, call options are an ideal way to play a bullish slant on XLK. Buying a call on the fund allows you to participate in continued gains, while simultaneously lowering your overall dollars at risk, relative to an equivalent share purchase.

That said, volatility on XLK options is somewhat elevated at the moment. Trade Alert pegs the ETF's 30-day at-the-money implied volatility at 14.1%, which registers in the 82nd annual percentile. To defray the time value expense on a bullish XLK trade, speculators may wish to bet on a July rally via a vertical call spread, where a higher-strike call option is sold and a lower-strike call option is purchased.