Trade Idea: For the time being, avoid this USD market all together. In addition, it’s critical that you evaluate current positions and any new trades you are considering with respect to those positions’ correlation to the US Dollar, asserts Landon Whaley.

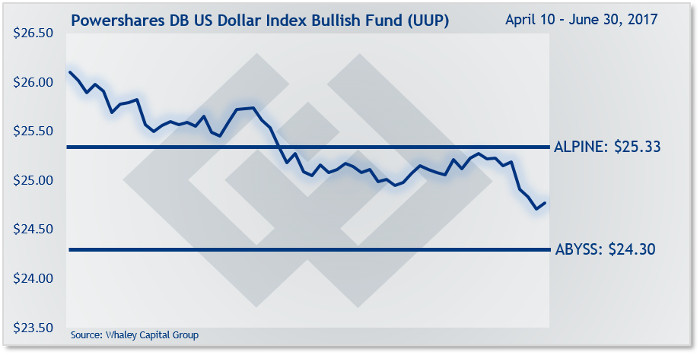

PowerShares DB US Dollar Index Bullish Fund (UUP) declined another 1.7% in the week ending June 30.

The second quarter of 2017 marked the US Dollar’s worst quarterly performance since 2010.

The most recent catalysts for the greenback’s weakness are: skepticism over the Fed’s rate hike intentions, the continued flattening in the US yield curve and the ECB’s next policy move.

All eyes are on Janet Yellen as we move forward because investors believe the Fed is looking at the US economy through rose colored glasses, which is leading the market to doubt the Fed’s intended rate hike path. This perception of policy uncertainty is muddying the US Dollar’s Fundamental Gravity, despite the fact that US growth continues to accelerate.

Quantitatively, it’s quite simple, the US Dollar and UUP are a train wreck.

I would avoid long USD or UUP trades unless, and until, these instruments regain the $96 and $25.56 price levels, respectively.

Behaviorally, long positioning is at both one and three-year lows because bulls capitulated and tossed in the towel towards the end of Q2. I’ve been neutral on the USD for 16 consecutive weeks and I see no need to move off that bias now.

Remaining Neutral and on the sidelines.

Trade Idea: For the time being, avoid this market all together. In addition, it’s critical that you evaluate current positions and any new trades you are considering with respect to those positions’ correlation to the US Dollar.

The most likely direction for the greenback from here is lower. This means that markets or stocks with a negative correlation should benefit from a lower USD while positions with a positive correlation will most likely face a significant headwind from a weaker greenback.