The best bet is to maintain your market exposure to ride out the summer, possibly taking advantage of shorter term trading opportunities that may arise, asserts Marvin Appel, MD, PhD. He’s president of Signalert Asset Management LLC.

State of the Market: Summer starts with a month of stock market stalemate as foreign stock indexes join the S&P 500 Index in flattening out.

The market seems to be stuck between the opposing forces of favorable earnings (bullish) and unfavorable monetary developments as the Fed continues to retreat from its long stretch of aggressive stimulus (bearish).

With our equity models overall neutral-bullish, downside risk should remain modest. But with stocks richly valued, upside potential is also modest, particularly during the seasonally unfavorable May-October period.

The best bet is to maintain your market exposure to ride out the summer, possibly taking advantage of shorter term trading opportunities that may arise.

June employment report: Sell on the rumor, buy on the news.

The U.S. added 222,000 jobs in June, well above expectations and nearly twice the number required to keep up with population growth. The unemployment rate ticked up to 4.4% (up from 4.3% in May) as more previously idle Americans decided to rejoin the labor force.

Wages rose 2.5% from a year ago, slightly ahead of inflation.

This strong report would be expected to drive interest rates higher. In fact, on Friday morning (July 7) 10-year Treasury note yields were up two basis points to 2.39%. But the bulk of the recent jump in 10-year yields occurred in advance of the report.

The chart shows that 10-year Treasury note yields began 25 basis point jump (so far) on June 27, the largest bump in yields since March. The iShares Total Bond Market ETF (AGG) has fallen into the support area around $109.10.

The chart suggests that yields could potentially rise to retest the 2.6% level seen in December and March.

However, the modest jump on the day of the employment report suggests to me that the good employment news was already mostly priced into the bond market so that in the near term, additional yield increases will be modest. I expect yields to stay around the 2.42% area that was the May peak.

The bond market’s pullback last week makes investment-grade bond funds appear more attractive, although with real investment-grade bond yields near zero there are certainly no bargains in the bond market.

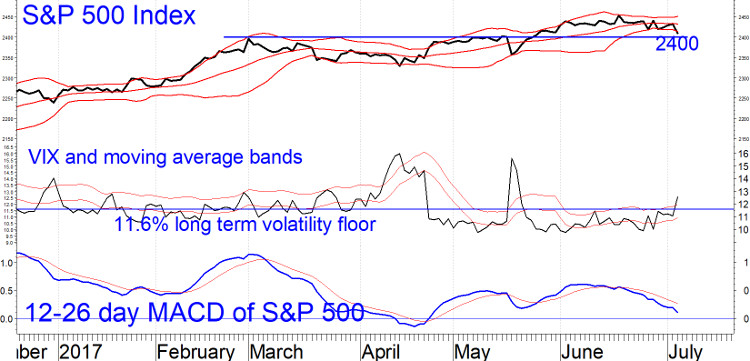

S&P 500 holds above 2400 support level

The S&P 500 has been scraping along its lower Bollinger band in recent days while its MACD has fallen towards zero. (See chart.) In an overall sideways market, which is what I believe to be the prevailing intermediate-term climate, this raises the possibility that we will soon see a short-term bottom fishing opportunity, particularly if MACD gets below zero to indicate an oversold condition: 2400 is a potential support area.

The chart also shows CBOE Volatility Index (VIX), which has spent much of this year plumbing record lows. If the S&P 500 Index were to fall another 1% to 2400 and VIX were to pop up to 14% or higher (as occurred on May 17, for example), that would be a bottom fishing opportunity for covered call writing with SPDR S&P 500 Trust ETF (SPY).

Subscribe to investment newsletter Systems and Forecasts here…